Need to Open a Portuguese Bank Account? We’ve Got You Covered!

Your Portuguese bank account is just a click away.

Our trusted local banking partner ensures you can open a bank account from anywhere in the world.

Opening a Portuguese Bank Account for Visa Applications Just Got Easier.

We’re here to help with your bank account opening process right from your home country.

Bypass Bureaucracy

No need for an Apostille. Get your signature legally recognized by a law firm in Portugal, turning weeks of waiting into minutes.

Tailored Service

Enjoy the luxury of having a private bank manager as your main point of contact for all banking needs.

Smooth Process

We’ve simplified the Portuguese bank account opening process into 5 easy-to-follow steps. Sit back and let us do the work!

The account can be provided by Novobanco, one of Portugal’s leading private banks.

This account we’ll provide you a gateway to hundreds of branches and ATM access across the country. Both individual and joint accounts are supported.

Our fee package covers the cost of signature certification by a law firm in Portugal, negating the need for document notarization or apostille.

Our account comes with a host of benefits, the key being a dedicated, English-speaking bank manager who becomes your primary contact with the bank.

The monthly maintenance fee depends on the account type selected.

We offer the Prestige NB 360 account with a monthly fee of 8.20 EUR.

Opening an account requires a minimum deposit of 250 euros.

REQUIREMENTS

Here are 5 Key Documents you’ll need to get started.

Please note: All documents submitted must be either in English, Spanish, French or Portuguese. Otherwise you’ll need a certified translation.

Proof of address

You will need to provide a document that verifies your current address in your country of residence. What can I use as Proof of Address? Click here

Proof of Employment or Financial Means

You’ll need to demonstrate proof of employment or financial means. Not sure what qualifies? Find out here

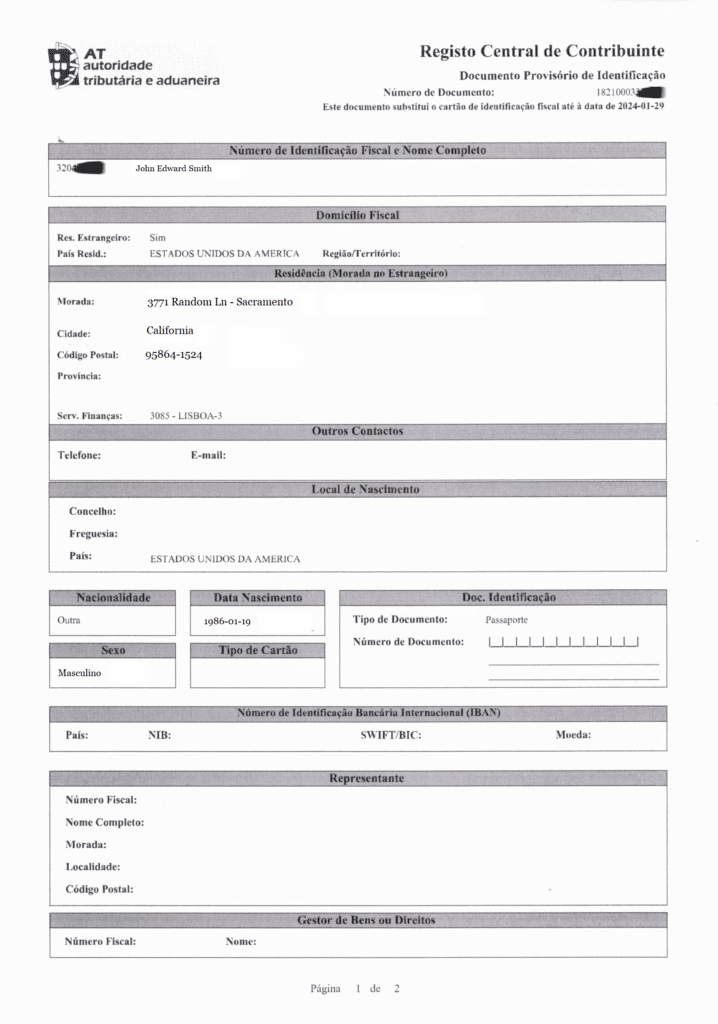

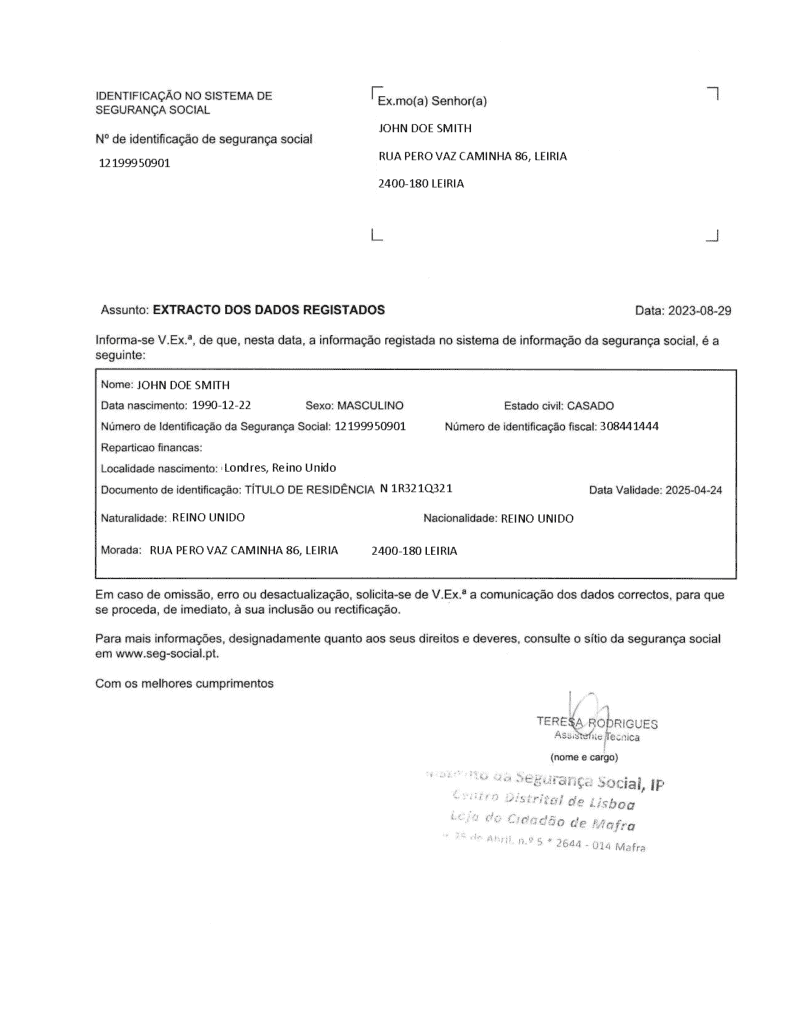

Portuguese Tax Identification Number (NIF)

The NIF is a tax identification number issued by the Portuguese Tax Department. If you don’t already have an NIF, you can apply for one here

Remember, the documents listed above are essential for account opening. The bank may request additional documents based on your citizenship, employment, and other relevant factors.

Compare and Save: NIF, Bank, and Bundle Packages

NIF

1 NIF

79€

One Time Payment

Required Documents:

- Passport or EU National ID card

- Proof of address

Bank Account

1 Bank Account

300€

One Time Payment

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Portugal NIF document

- Tax number from the country of residence

Solo Package

1 NIF + 1 Bank Account

359€

Save 20€

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Tax number from the country of residence

Couple Package

2 NIFs + 1 Joint Bank Account

428€

Save 30€

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Tax number from the country of residence

Get Your Portuguese Bank Account with 4 Easy-to-Follow Steps

Begin Your Application

Submit a processing fee of 300 EUR and fill out a quick online form

Upload documents

Upload all required documents via our secure portal

Sign the application to open a bank account

Have your signatures authenticated by a law firm in Portugal

Start Banking!

Get access to your online bank, meet your bank manager and receive your cards at your preferred address or at your closest bank branch within Portugal

5-STAR REVIEWS

Hear it from our happy customers

PORTUGAL BANK ACCOUNT

Frequently Asked Questions

A Bank Account For Every Need

D7 Visa

Golden Visa

Startup Visa

Property Purchase