Get Your NIF in Just 1-3 Days: One Payment, 100% Online

Join over 1,634+ Clients Who Have Successfully Received Their NIF with Us

1-3 Business Day Turnaround without extra costs! (Last Update: April 12, 2024)

100% Risk Free – Request full refund if no NIF in 5 business days

Minimal human interactions & automated updates

Special April Discount: €119 €79 (Save €40) – Offer Expires on April 30!

Get Your NIF in Just 1-2 Days: One Payment, 100% Online

Recent Clients Have Enjoyed a 1-2 Business Day Turnaround for Our NIF Service! (Last Update: Feb 7, 2024)

Join the NIF Express Lane: No Waiting, No Worrying, Just Pure Speed. 🚗💨

NIF Done-For-You Service: €119

😍 Valentine’s Special: €79 (Save €40) – Offer Expires on Feb 14th! 💘

Fastest NIF Service Guaranteed!

Your NIF in Portugal: No Complications, Just Solutions

If you’re setting roots in Portugal, securing a NIF is step one. With Novomove, we make it as breezy as a day at the Nazare beach.

Fast

Simply complete our online form to get the process started. You can expect to receive your Portuguese NIF within 3 days.

NIF with Tax Representation

Non-EU/EEA residents get free 12-month tax representation. EU/EEA residents can opt for optional tax representation.

Secure

Safeguarding your personal data is our top priority. Once the order is completed – your data is removed.

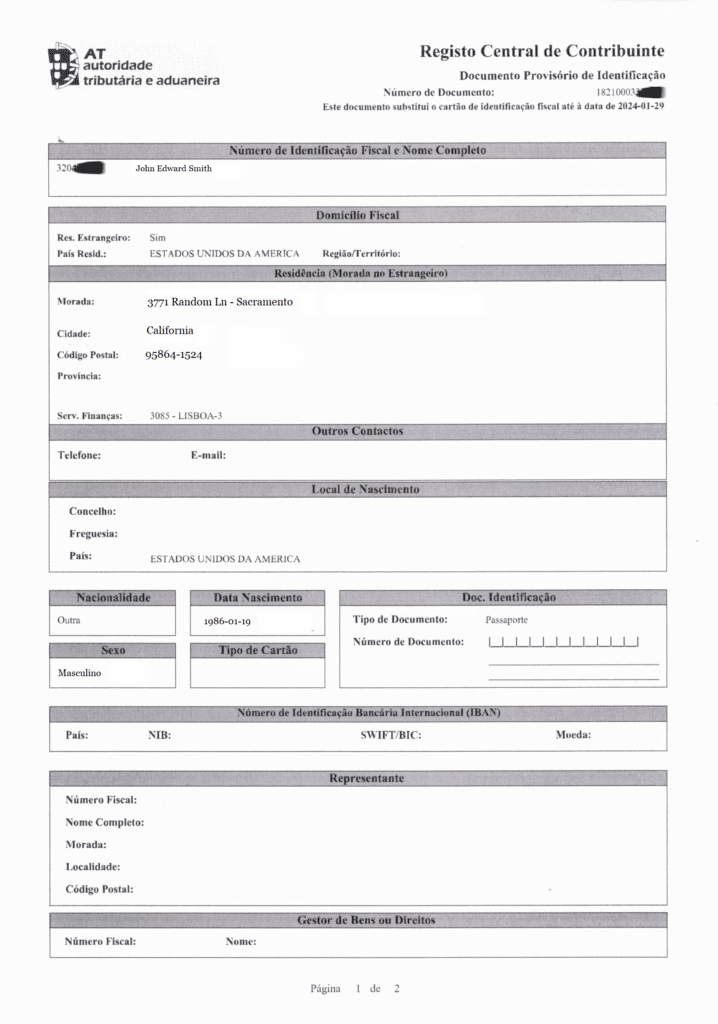

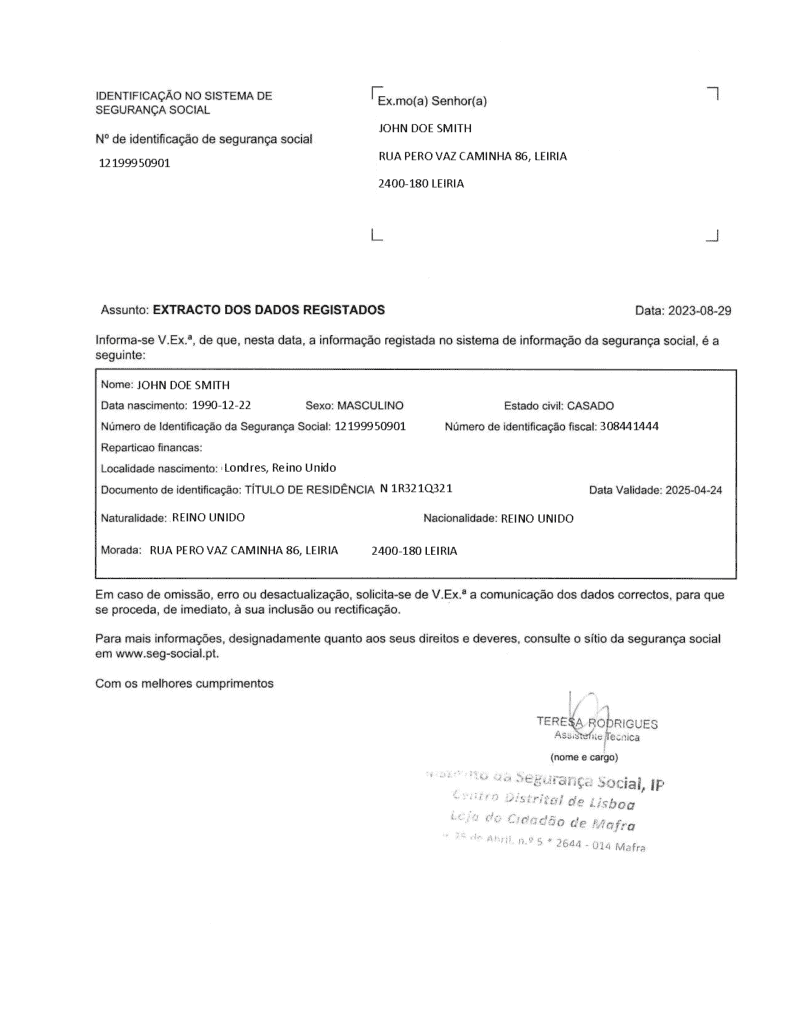

To jumpstart the process, you’ll only need 2 Documents.

Please note that additional requirements apply for minors and individuals who were born in Portugal or hold Portuguese citizenship.

Get Your NIF in 3 Easy Steps…

Fill Out Easy Online Application

Sign your Power of Attorney

Get Your NIF in 1-3 Days

Obtaining Your NIF Has Never Been Simpler

We help our clients get their NIF effortlessly, ensuring they can comply with bank account opening requirements and easily establish themselves in Portugal, no matter where they are in the world.

With minimal time and effort, your NIF will be ready for you, allowing you to focus on what matters most: enjoying your new life in Portugal.

You’ll no longer feel overwhelmed by the task of dealing with complex Portuguese procedures and paperwork to obtain your NIF on your own.

Compare and Save: NIF, Bank, and Bundle Packages

NIF

1 NIF

79€

One Time Payment

Required Documents:

- Passport or EU National ID card

- Proof of address

Bank Account

1 Bank Account

300€

One Time Payment

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Portugal NIF document

- Tax number from the country of residence

Solo Package

1 NIF + 1 Bank Account

359€

Save 20€

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Tax number from the country of residence

Couple Package

2 NIFs + 1 Joint Bank Account

428€

Save 30€

Required Documents:

- Passport

- Proof of address

- Proof of employment

- Tax number from the country of residence

5-STAR REVIEWS

Hear it from our happy customers

Don’t Get Stuck or Rejected Applying for Your NIF on Your Own

Don’t waste time dealing with complicated and confusing Portuguese procedures on your own

Experience the fastest and safest way to get your NIF and spend more time doing what you love

Avoid missing important deadlines

Don’t continue getting overwhelmed working through complex documentation to figure out how to get your NIF, a very costly mistake if not done right

Use Your NIF To

Buy a Car

Purchase a Property

Rent an Accommodation

Open a Bank Account

Set up Utilities

Start a Business In PT

100% Money-Back Guarantee

We eliminate any hesitation or stress you may feel by taking all the risk for you to make sure you get your NIF

Our guarantee to you is very simple:

Get Your NIF in 5 business days or 100% Your Money Back.

PORTUGAL NIF

Frequently Asked Questions

Don’t Wait! Start Your Application Now!

Comply with Portuguese tax reporting requirements and avoid missing important deadlines. Prevent your NIF application from being rejected by using our quick online application process.

Get Your NIF Online – Accessible Globally