How to get a Portuguese NIF: A Rite of Passage for Expats

If you have already been to a grocery store in Portugal you might have been perplexed by the sound of contribuinte? Maybe, you have heard the longer version: “precisa contribuinte na fatura?”

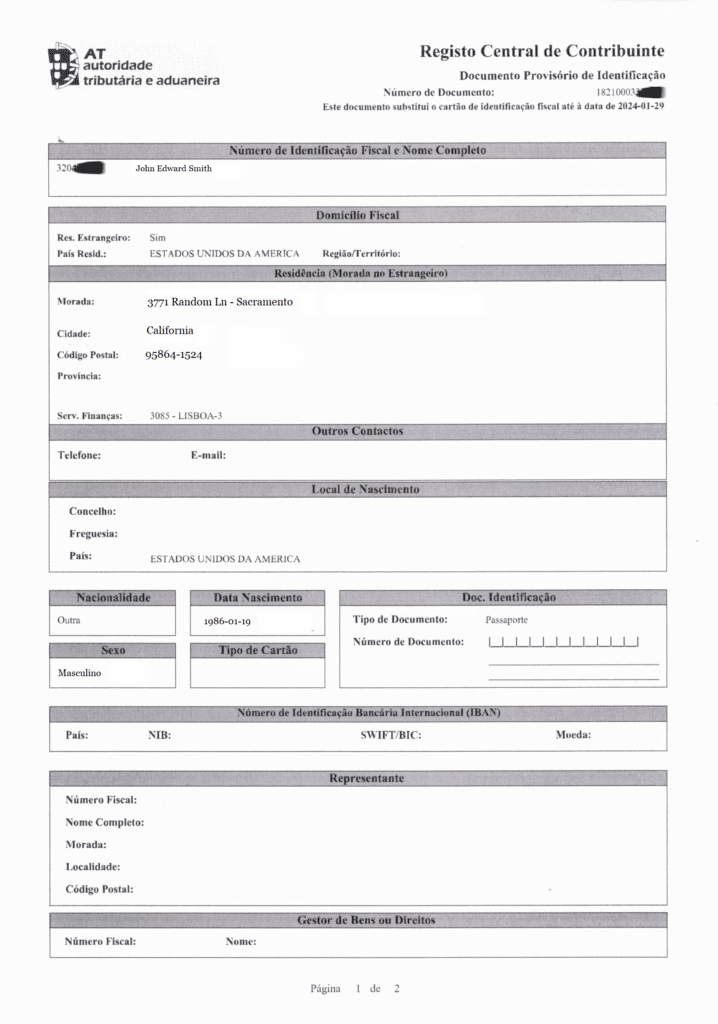

Contribuinte, short for número de contribuinte, is a way to refer to the Número de Identificação Fiscal (NIF). The NIF is the Tax Identification Number (TIN) used by most European countries to identify tax payers and facilitate the administration of tax affairs.

TIN specifications are set by the countries’ national authorities. In Portugal, the NIF is a nine-digit number associated with nationals’ citizen cards. The NIF does not expire. It is issued by the Tax and Customs Authority. Spoiler: The Tax and Customs Authority website is mostly in Portuguese!

In this post, we will explain why anyone moving into Portugal should get a NIF, and provide a step-by-step guide on how to obtain it. Let’s cut through the confusion!

A Portuguese NIF Is a Must-Have

Some websites offer detailed lists of who needs to get a NIF.

Our approach is simple: if you have decided that the land of Fado is for you and you are coming to Portugal, you will need a NIF sooner rather than later. It doesn’t really matter what you will be doing in Portugal.

Whether surfing the waves for fun, surfing the web for work, or surfing through your retirement funds, you will definitely need a NIF. It is worth taking the time to surf through the NIF application process!

A Roadmap of How to Get a NIF if You Are an EU Citizen

According to ePortugal, an official online portal for over 1,000 public services, “foreign nationals, resident or non-resident in Portugal, who have to comply with tax obligations (payment of taxes) or wish to exercise their rights before the Portuguese tax administration” can apply for a NIF.

As expected, EU nationals enjoy a relatively simple process when applying for their NIFs.

One essential aspect is whether the EU national wants to be considered a Portuguese resident or non-resident for tax purposes. You will usually be considered a tax resident in the country where you spend more than 6 months a year.

This distinction is strategic for your tax obligations and might affect your Non-Habitual Resident (NHR) status.

For the NHR program in Portugal, the 10-year duration begins from the date the individual registers as a tax resident in the country, which may not be the same as the date they applied for their NIF. We recommend checking with a tax specialist beforehand.

- EU National applying as a tax resident in Portugal: you need an identity document, a passport, or a certificate of registration as a European Union citizen (CRUE), issued by your local council

- .EU National non-tax resident in Portugal: you need an identity document or a passport.

In both cases (EU tax and non-tax residents), you can apply for your NIF

- Directly at a Finanças office. Click here for tips

- Through a fiscal representative: “a natural or legal person, domiciled in Portugal, who expressly declares acceptance of representation” (Portuguese Diplomatic Portal).

- Through a relocation agency.

The last two are obviously your way to go if you are not in Portugal. It is not possible to obtain your NIF online directly with Finanças. You might run into “NIF online” options when you search. However, all these options will redirect you to online services that handle expats’ relocation.

A Roadmap of How to Get a NIF If You Are Not an EU Citizen

As a non-EU citizen, obtaining your NIF is still necessary and more complex than for EU nationals.

According to the official information from ePortugal, if you are already in Portugal and want to apply for the NIF as a tax-resident

- Documentation: an identity document or a passport and your residence permit (even if it is temporary).

- Make an appointment at 217 206 707 (Monday-Friday, from 9 am to 7 pm)

- When you arrive at the Finanças office, take a senha (queue ticket) and wait for your number to appear on the screen.

The information on ePortugal for non-EU citizens who want to apply for their NIFs from abroad is outdated.

The latest information from the Tax and Customs Authority (Ofício Circulado N. º: 90057 2022-07-20 ) states when a non-EU citizen residing outside of Portugal would need fiscal representation. Fiscal representation is only mandatory if, after receiving the NIF,

- you own a vehicle registered in Portugal:

- you own property in Portugal;

- you enter into an employment contract in Portugal;

- you register as self-employed in Portugal

As these exceptions will not cover most of the people relocating to Portugal, our advice is to apply for the NIF with a fiscal representative or to hire the services of a relocation agency or a lawyer.

Getting a Fiscal Representative in Portugal

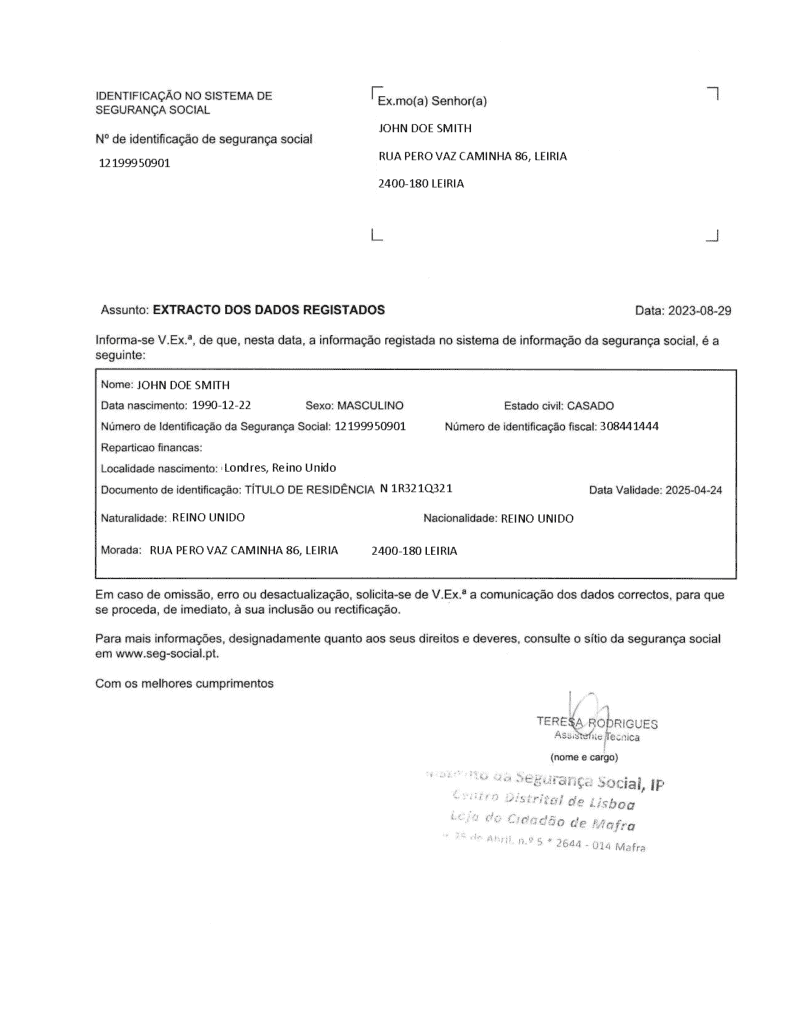

Fiscal representation can be established in different formats.

As a foreigner you can contractually hire a fiscal representative (lawyer, accountant, consultant, etc.) or informally appoint a Portuguese friend or family member as your fiscal representative.

Anyone with a tax address or head office in Portugal may be appointed as a fiscal representative.

If the non-resident applying for the NIF exercises a self-employed activity subject to Value Added Tax (VAT), the fiscal representative must be a VAT taxpayer (resident in Portugal).

Do You Need a Lawyer to Obtain Your NIF?

The straight answer is no: you do not need a lawyer to just obtain your NIF. However, if you are buying real estate property and/or opening a business in Portugal, you should get a lawyer.

As buying real estate or registering a business will require you to have a NIF, your lawyer can assist you with the process.

The NIF: Tricks and Tips

Looking to get your hands on the Portuguese NIF? Don’t worry! We’ve got some tricks up our sleeves to help you snag that elusive number.

- When you show interest in a property (buying or renting) your realtor might offer to help you with your NIF. Once one of the realtors we used to search for a house realized that we were serious about buying property, she offered to do the NIF for us.

- If you are hiring any service for your relocation to Portugal (visa consultant, realtor, travel agent, lawyer, etc.) ask them if they can include the NIF as part of the service.

- The NIF can be issued by any Finanças office. It does not have to be the one in your municipality.

- When you call 217 206 707 to make your appointment, ask the agent for the office closest and least busy. Agents are usually very friendly and will be happy to talk to you in English.

- No matter what identity document you are using to obtain your NIF, always take with you proof of address.

Conclusion

In this post, we have provided a step-by-step guide to obtaining a Número de Identificação Fiscal (NIF), which is necessary for anyone living in Portugal. While we do recommend that you complete your homework with all the “assigned readings”, we have prepared a very brief summary of what you need to obtain a NIF:

- EU nationals: passport or identity document directly at a Finanças office or through a fiscal representative or a relocation agency.

- Non-EU citizens: You will most likely need a fiscal representative/relocation agency/lawyer/consultant if you are not in Portugal. The documents needed are an identity document or a passport and proof of address.

- The NIF does not expire.

- Make sure that your tax residency is clear before you start your NIF application.