NHR 2024 Transitory Regime in Portugal: Who’s In and Who’s out?

You’ve probably heard the buzz about the Non-Habitual Resident (NHR) program’s end after a short notice from the government of Portugal.

Instead, a new scheme was introduced called the Tax Incentive Scheme for Scientific Research and Innovation (TISRI in short). Some call the new TISRI tax regime as NHR 2.0, but this is a bad comparison since these are 2 different tax regimes.

If you had plans to move to Portugal before 2024, you may still be eligible to apply for the original NHR regime by following NHR transitory rules introduced in the Portuguese State Budget for 2024.

NHR application update for 2024

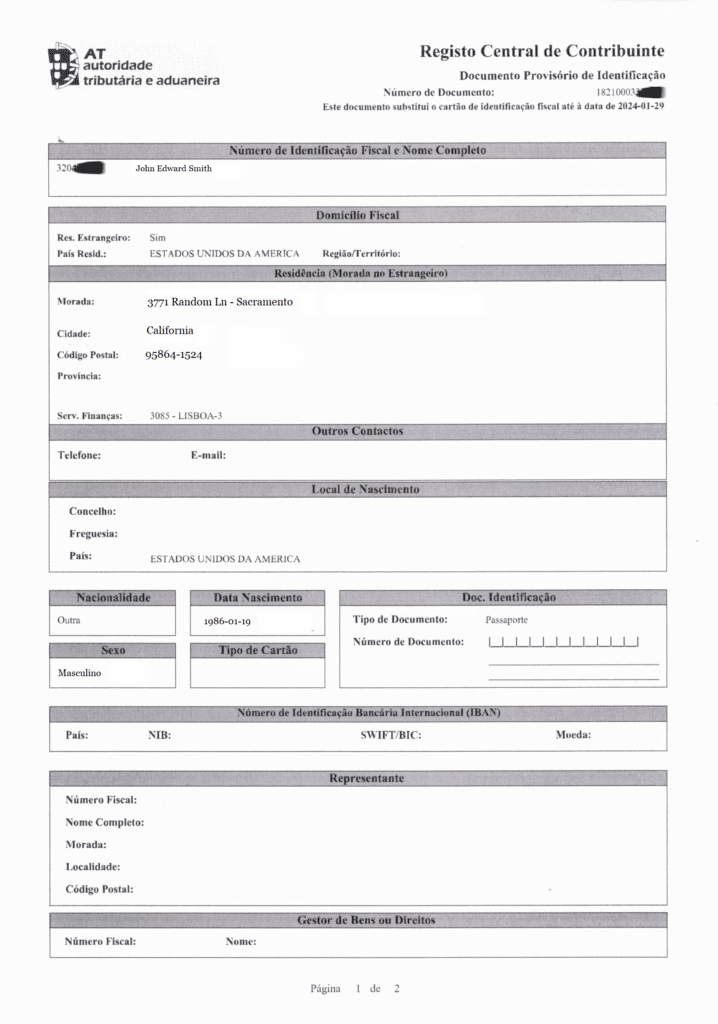

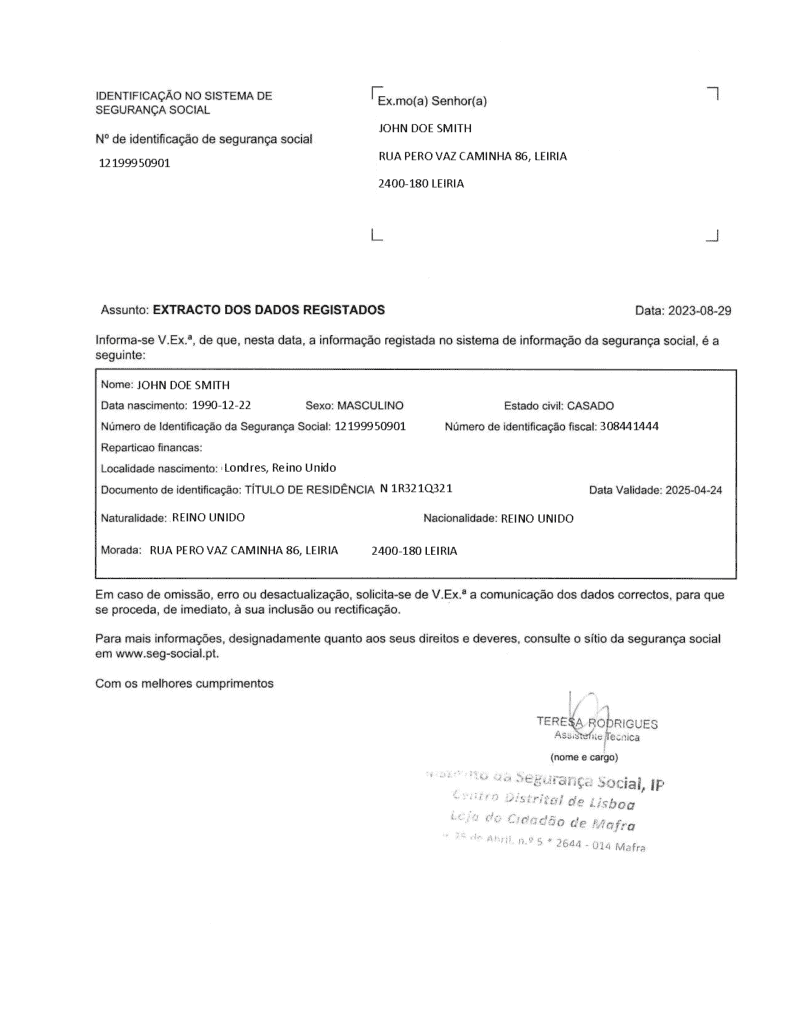

Currently, tax authorities automatically reject all NHR applications. They then request specific documents to confirm eligibility in a separate notice.

For those becoming tax residents in Portugal by December 31, 2024, you will need any of the following documents to support your NHR application:

– A Portuguese work contract or promise signed before December 31, 2023.

– A property lease or agreement signed by October 10, 2023, for use in Portugal.

– A property reservation or promise signed by October 10, 2023.

– Enrolling dependents in a Portuguese educational institution by October 10, 2023.

– Possession of a valid residence visa or permit until December 31, 2023.

– Starting the residence visa or permit process by December 31, 2023, by scheduling an appointment or submitting an application to the competent authorities, as per immigration laws.

Also, family members of a taxpayer who has any of the above grounds can apply for the NHR.

Exploring Tax Legislation: Extract from Article 236’s Transitional Provisions of State Budget 2024

Check out the full excerpt taken straight from the legislation Lei n.º 82/2023, de 29 de dezembro.

Article 236

Transitional provision within the scope of personal income tax

1 – The amounts attributed to workers as a share in the company’s profits, via balance sheet bonus, paid by entities whose appreciation nominal fixed remuneration of all workers in 2024 is equal to or greater than 5%.

2 – Exempt income under the terms of the previous paragraph is included for the purposes of determining the rate applicable to other income.

3 – The provisions of paragraphs 8 to 12 of article 16, in article 22, in paragraphs 10 and 12 of article 72, in paragraphs 4 to 8 of article 81, in paragraph 8 of article 99 and paragraph d) of paragraph 1 of article 101 of the IRS Code, in the wording prior to that introduced by this law, continues to be applicable, until the end of the period set out in No. 9 of article 16 of the IRS Code, in the wording prior to that introduced by this law, counting from the date on which the taxpayer became resident in Portuguese territory, to the taxpayer who:

a) On the date of entry into force of this law, you are already registered as a non-habitual resident in the AT taxpayer register, until the period referred to in paragraphs 9 to 12 of article 16 of the IRS Code;

b) On December 31, 2023, meet the conditions of article 16 of the IRS Code to qualify as a resident for tax purposes in Portuguese territory;

c) Become a resident for tax purposes by December 31, 2024 and declare, for the purposes of registering as a non-habitual resident, that you have one of the following elements:

i) Promise or employment contract, promise or secondment agreement signed by December 31, 2023, whose duties must take place within national territory;

ii) Lease contract or other contract that grants the use or possession of property in Portuguese territory concluded until October 10, 2023;

iii) Reservation contract or promissory contract for the acquisition of real rights over property in Portuguese territory concluded by October 10, 2023;

iv) Enrollment or registration for dependents, at an educational establishment domiciled in Portuguese territory, completed by October 10, 2023;

v) Residence visa or residence permit valid until December 31, 2023;

vi) Procedure, initiated by December 31, 2023, for granting a residence visa or residence permit, with the competent entities, in accordance with the legislation in force applicable to immigration matters, namely through the scheduling or effective request scheduling the submission of the application for the granting of a residence visa or residence permit or, even, by submitting the request for the granting of the residence visa or residence permit;

d) Be a member of the household of the taxpayers referred to in the previous paragraphs.

4 – For the purposes of paragraphs c) and d) of the previous paragraph, the taxpayer must request registration as a non-habitual resident, electronically, on the Finance Portal, after the act of registration as a resident in Portuguese territory, under the terms of paragraph 10 of article 16 of the IRS Code, in the wording prior to that introduced by this law, by reference to the year in which he became resident in that territory.

5 – In cases where registration is carried out outside the period referred to in paragraph 4, taxation under the terms safeguarded in this article takes effect from the year in which registration is carried out, for the remaining period, until the end of the period provided for in paragraph 9 of article 16 of the IRS Code, in the wording prior to that introduced by this law, counting from the year in which you became resident in that territory.

6 – The limit set out in paragraph 1 of article 12-A of the IRS Code, as amended by this law, applies only to taxpayers who become tax resident in the year 2024 or later.

Source: Lei n.º 82/2023, de 29 de dezembro