Ultimate Guide to Tax-Free Shopping in Portugal: Maximize Your Savings as a Tourist

Discover how to make the most of tax-free shopping in Portugal with our ultimate guide. Learn the ins and outs of the Tax-Free system, eligibility, and step-by-step process to reclaim VAT on your purchases and enjoy a more cost-effective travel experience.

I validated the information about values and deadlines in this leaflet from the Portuguese Tax and Customs Authority: e-Taxfree Portugal – Português (portaldasfinancas.gov.pt)

Tax-Free Shopping in Portugal: The Ultimate Guide for Tourists

Introduction

Preparing for a journey to Portugal and eager to optimize your shopping adventures? Portugal offers an excellent tax-free shopping opportunity for tourists outside the European Union.

Our complete guide offers all the essential details for maximizing the tax-free system, helping you save on your shopping, and enhancing your overall travel experience. So, let’s dive in and explore tax-free shopping in Portugal!

In Portugal, the e-tax-free system enables tourists from outside the European Union to claim a refund on the Value Added Tax (IVA) they paid on their purchases.

The IVA rates in the country are 23% on the mainland, 22% in Madeira, and 18% in the Azores. The e-tax-free system enables retailers participating in the tax-free program to report sales made under this scheme electronically and in real-time to the Autoridade Tributária e Aduaneira (AT), the Portuguese Tax and Customs Authority.

The tax-free system benefits tourists by reducing waiting times during the purchasing process and at customs when leaving Portugal.

It also increases the competitiveness of Portugal as a shopping destination compared to other countries. Simultaneously, the system improves the control of the AT, which can now monitor all transactions made under this regime, reducing the possibility of tax fraud.

Eligibility Criteria for Tax-Free Shopping

To be eligible for tax-free shopping in Portugal, you must:

- Be a resident of a non-European Union country (regardless of nationality)

- Your purchases must not be of a commercial nature

- Make a purchase that meets the minimum amount required of 50€ (without taxes)

- Shop at a store that participates in the tax-free program

- You are leaving the European Union with the goods in your luggage staff until the end of the third month following the purchase.

Participating Stores and Identifying Them

Regarding tax-free shopping in Portugal, knowing which stores participate in the program is essential, as not all offer this service. To help tourists identify these stores, participating retailers typically display a “Tax-Free” sign or sticker prominently on their windows or near the cash register.

This signage helps to ensure shoppers can easily recognize the establishments where they can benefit from tax-free shopping.

If you’re uncertain about a store’s participation in the tax-free program, feel free to inquire with the staff for confirmation. They can let you know if their store is included in the program and help you with the steps required to claim your tax refund.

Some large department stores, like El Corte Inglés, offer at their customer service desks. This service provides a more convenient way for tourists to claim their tax savings without going through the airport process.

Providing immediate refunds, these stores help their customers save precious time and energy, ensuring a more pleasant and seamless tax-free shopping experience.

Minimum Purchase Amount for Tax-Free Shopping

In Portugal, tourists who want to take advantage of tax-free shopping must meet a minimum purchase threshold to qualify for a refund.

The minimum purchase amount is €61.50 (taxes included), which must be spent within a single store to be eligible for tax-free shopping. It’s important to note that this limit applies per store, so you cannot combine purchases from different stores to reach the minimum threshold.

Remember that the tax-free system only covers goods and not services is crucial. This implies that costs associated with accommodations, dining, vehicle rentals, or other comparable services do not qualify for tax refunds.

Concentrate on purchasing items such as apparel, keepsakes, beauty products, and gadgets, as these are typically products eligible for tax-free shopping.

However, some exceptions exist to the types of goods eligible for tax refunds. For example, the tax-free shopping program does not cover certain products like appliances and furniture.

These items are generally excluded due to their size, weight, and the complexities of transporting them across borders. Always check with the store staff if you need clarification on the eligibility of a specific product for tax-free shopping.

How to Claim Tax-Free Shopping in Portugal

To claim tax-free shopping in Portugal, follow these steps:

- Make your purchase: Ensure that you have spent at least €61.50 (taxes included) in a single store and that the store participates in the tax-free program.

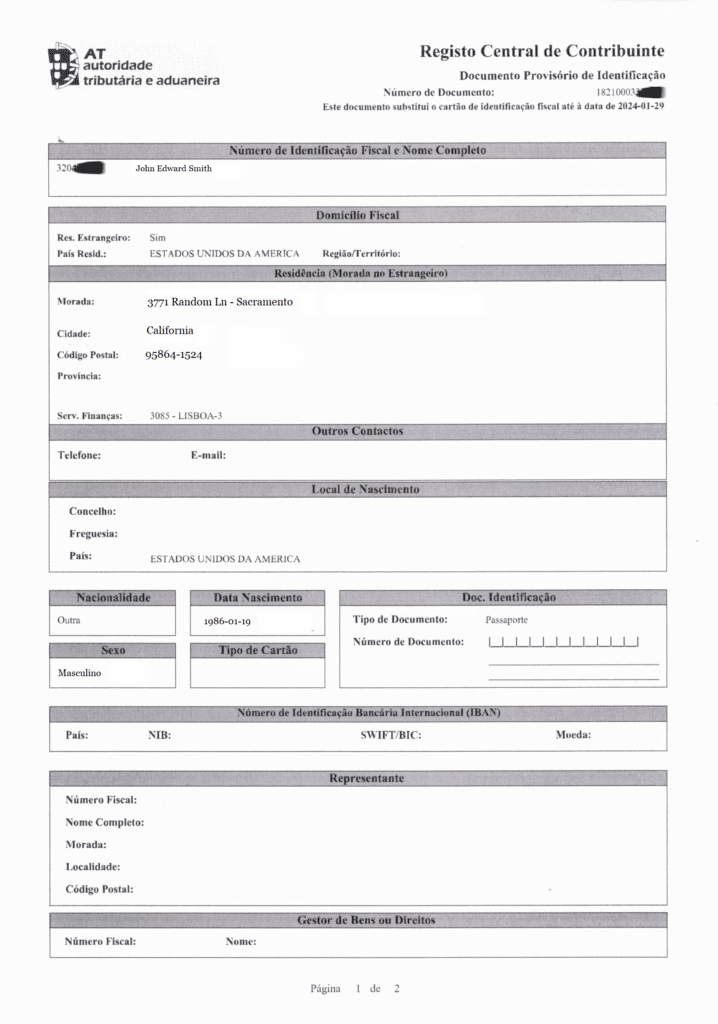

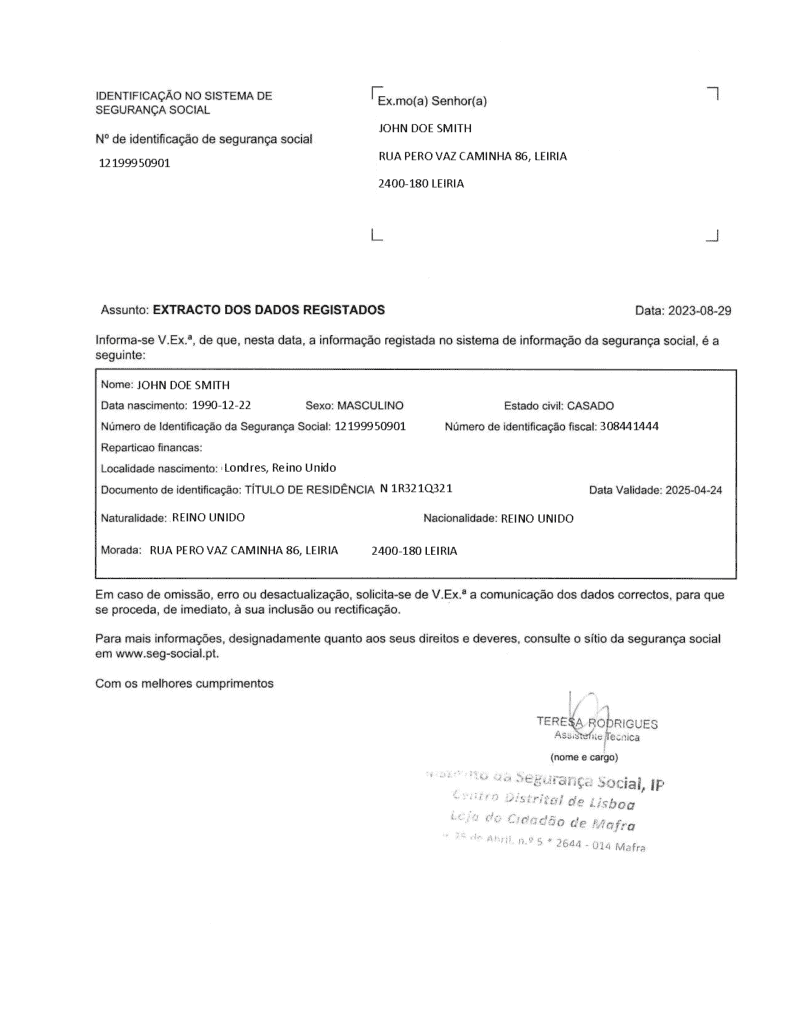

- Request a tax-free form: At the time of purchase, ask the cashier for a tax-free state. You need to complete a form with your personal information. Some stores may ask to see your passport to verify your eligibility, so keep it handy.

- Choose your refund method: Indicate on the form whether you want to receive your refund incash or as a credit card reimbursement. Please keep the receipt; you’ll need it later when claiming your refund.

Receiving Your Tax Refund

To receive your tax refund in Portugal, follow these steps:

- Prepare your documents: Before heading to the airport, make sure you have your tax-free form, receipt, and the purchased goods with you. Keep them readily accessible, as you may need to present them at customs.

- Arrive early at the airport: Give yourself ample time to go through the tax-free process at the airport, as it may take some time, especially during peak travel seasons. Plan to arrive at least three hours before your flight’s departure.

- Complete your check-in: First, obtain your boarding pass by completing your check-in. You can do this by:

Online check-in

If you’ve completed online check-in, head directly to the Tax-Free kiosks.

Self-service check-in kiosks

If you still need to check in, complete your check-in at your airline’s kiosk.

Airline check-in counter

If you’re traveling with children or encountering issues with the self-service kiosk, head to the airline’s check-in counter.

If you plan to check the Tax-Free products in your luggage, inform the employee that you will still complete the Tax-Free process. Your luggage will be tagged commonly but returned to you for customs inspection if necessary.

Head to the tax-free electronic kiosk

In the airport’s departure area, scan your passport and boarding pass. The purchases will already be associated with your passport due to the data filled in at the store during the purchase.

Validate your Tax-Free status

• If a green light appears on the kiosk, validate and proceed. You can now check in your luggage at the regular counter if you haven’t done so already.

• If a red light appears, go to the Tax and Customs Authority counter for your purchases to be inspected by an agent. Present your documents and products (if requested), and you’ll receive an official stamp. Your luggage will be checked in from the customs counter (if applicable).

Claim your refund

After completing the validation process, head to an airport currency exchange office or a Tax-Free operator counter to receive your refund. Based on your preferred refund method, you will receive your refund either in cash (local currency or possibly USD) or as a reimbursement to your credit card.

In Portugal, four companies handle tax refunds: Global Blue, Planet Tax-Free, Innova Tax-Free, and Travel Tax-Free.

Continue boarding

After all these steps, continue with your normal boarding process, including security checks and immigration.

Shopping Tips for Tax-Free Experience in Portugal

To enjoy the benefits of tax-free shopping in Portugal, be well-prepared and have a plan in place. Start by researching stores and products you want to buy before your trip. This will save you time and ensure that you shop at participating tax-free stores.

Remember to bring your passport and any other necessary documents when you head out shopping, as some stores may require them for tax-free purchases. As you shop, keep all your receipts and tax-free forms securely, as you’ll need them to claim your refund later on.

Additionally, be aware of customs limits when shopping. Countries have different customs regulations and limitations on the value of goods that can be brought back without paying import duties.

To avoid surprises, check your home country’s customs rules before making significant purchases in Portugal. This way, you can shop confidently and enjoy your tax-free shopping experience.

Tax-Free Shopping in Other Countries

Besides Portugal, many other countries offer tax-free shopping for tourists, including most European countries, Argentina, Mexico, some Middle Eastern countries, and Australia.

Each country has its own rules and regulations regarding tax-free, so it’s essential to research the country’s program before planning your shopping spree.

Conclusion

Tax-free shopping in Portugal is an excellent opportunity for tourists outside the European Union to save on their purchases.

So, pack your bags, prepare your shopping list, and enjoy visiting this beautiful country while maximizing your savings! By understanding the process, criterias, and requirements, you’ll be well-prepared to take advantage of tax-free shopping during your trip to Portugal.

Are there any exceptions when using the Tax-Free electronic system at the airport?

If a red light appears on the Tax-Free kiosk, you must go to the Tax and Customs Authority counter for your purchases to be inspected by an agent. In this case, you must present your documents and products for inspection and receive an official stamp.

What is the minimum purchase amount required for tax-free shopping in Portugal?

To be eligible for tax-free shopping, you must spend at least €61.50 within a single store in Portugal.

How can I identify stores that participate in the tax-free program?

Participating stores usually display a “Tax-Free” sign or sticker on their windows or at the cash register. You can also ask the store staff if they participate in the tax-free program.

What documents do I need to prepare for the tax refund process at the airport?

You will need your tax-free form, receipt, and the purchased goods.

Does tax-free shopping apply to both goods and services?

No, the tax-free system only applies to goods, not services like hotels or restaurants.

How early should I arrive at the airport to complete the tax-free process?

You should arrive at least three hours before your flight’s departure to allow ample time to go through the tax-free process at the airport.

How can I receive my tax refund?

Depending on your chosen refund method, you can receive your refund in cash (local currency or USD) or as a credit card reimbursement.