Freelance Tax in Portugal: Navigating the Self-Employed Tax System

As a self-employed freelancer in Portugal, I know how challenging it’s to navigate the tax system in this coastal country when starting.

There’s a lot to consider and understand, which is tricky for every foreign worker, but especially for those doing freelance work or starting their business.

However, once you crack how the Portuguese tax system for freelancers works, you won’t dread the tax season and Impostosobre o Rendimento das Pessoas Singulares (IRS) anymore.

This comprehensive guide on tax registration and payment for freelancers in Portugal provides all the essential information you need. Let’s start!

Overview of the Tax System for Self-Employed Individuals in Portugal

- Responsibilities: Register as an independent worker, handle income tax (IRS), social security contributions, and VAT (unless exempt).

- Tax Categories: Be aware of different tax obligations and rates for freelancers, sole traders, and limited companies, including progressive income tax and flat rates.

- Accounting Methods: Choose between the Simplified Regime (flat tax rate) or the Organized Regime (detailed accounting records, progressive tax rates).

- Deductions and Benefits: Use tax deductions for business expenses, credits for specific activities (R&D, environmental protection), and Non-Habitual Resident (NHR) benefits if eligible.

- Deadlines and Social Security: Monitor tax deadlines (April 1-June 30) and manage social security contributions (standard rate 21.4%, exempt for first 12 months).

According to the 2022 reports of the Portuguese government, the number of self-employed workers (trabalhadoresindependentes) peaked in 2021 as 4.3 million people (approximately 17 percent of the population) worked independently.

Even though freelancers have flexible hours, they have the same responsibilities toward the Portuguese tax system as any other employee.

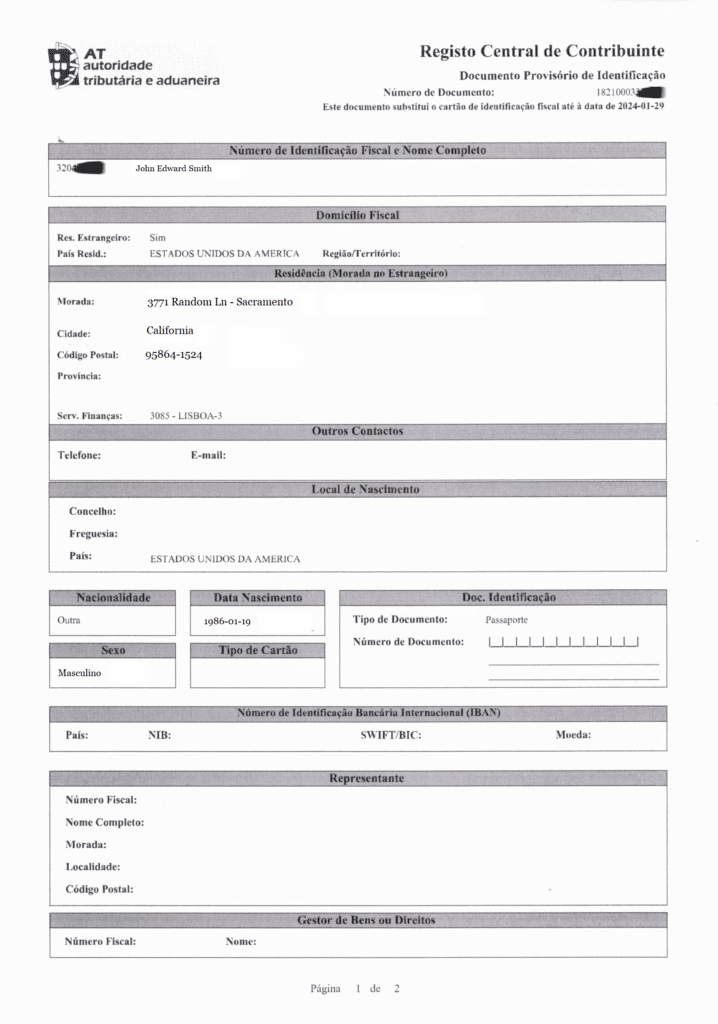

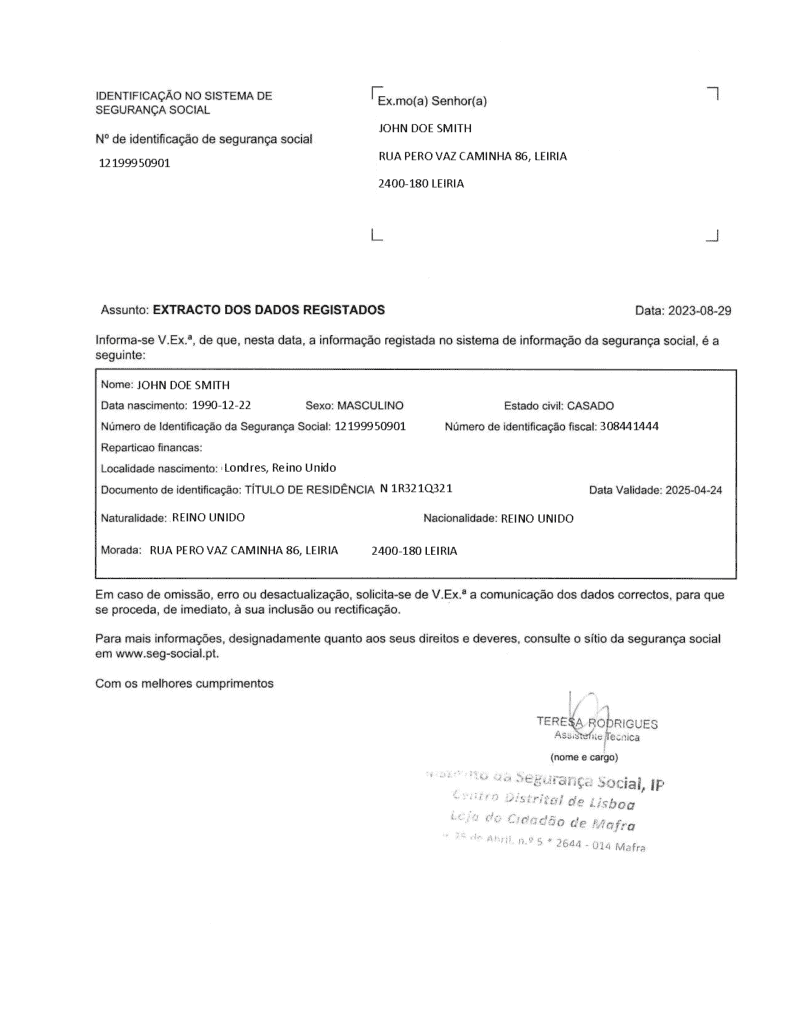

Independent workers in Portugal, including freelancers, must officially open their freelancing activity in Finances – either in person or online. Before you do that, ensure that you have the necessary documents:

- A valid visa or residence permit,

- Número de Identificação Fiscal (NIF number),

- Número de Identificação da Segurança Social (NISS number),

- An account in a Portuguese bank.

Freelancers in Portugal work with recibosverdes or green receipts. These are invoicing systems that independent workers use to invoice their clients and report income for tax and social security purposes.

Green receipts enable you to demonstrate to the authorities how much you earn, the monthly amount you must pay for social security, and how much you should pay for income tax (IRS). You can issue them as soon as you register as an independent worker and receive the confirmation of an open activity via post mail.

Hence, the self-employed tax system in Portugal requires you to pay IRS, monthly social security contribution, and, unless you’re exempt, IVA (VAT).

The Tax Differences Between Freelancers, Sole Traders, and Limited Companies

Here are the main differences between these three:

- Freelancers: They’re self-employed individuals who work independently and offer services to clients. These professionals are usually registered as “TrabalhadoresIndependentes” or “Recibos Verdes” and are subject to personal income tax (IRS) on their earnings. The IRS tax rates for freelancers in Portugal are progressive and range from 14.5 percent to 48 percent.

- Sole Traders: These individuals are known as Empresáriosem Nome Individual (ENI). They’re also self-employed individuals who run their businesses and are subject to personal income tax on their earnings. However, unlike freelancers, they are subject to a flat tax rate of 20 percent on their profits.

- Limited Companies: They’re known as Sociedadespor Quotas (LDA). They are considered separate legal entities from their owners and are subject to corporate income tax (IRC) on their profits. The current corporate tax rate in Portugal is 21 percent. In addition, limited companies must pay social security contributions to their employees.

| Entity Type | Description | Tax Type | Tax Rate |

| Freelancer | Self-employed individuals who work independently and offer services to clients. Registered as “Trabalhadores Independentes” or “”Recibos Verdes.” | Personal Income | Progressive (14.5% – 48%) |

| Sole Trader | Known as Empresáriosem Nome Individual (ENI). Self-employed individuals who run their businesses. | Personal Income | Flat (20% on profits) |

| Limited Company (LDA) | Known as Sociedades por Quotas (LDA). Separate legal entities from their owners, subject to corporate income tax (IRC) on their profits. Must pay social security contributions to their employees. | Corporate | Flat (21% on profits) |

Accounting Methods for Self-employed Workers in Portugal

Self-employed foreign freelancers in Portugal have two accounting methods at their disposal:

Simplified Regime (Regime Simplificado):

This is a flat-rate tax system for self-employed workers whose gross annual income is less than €200,000.

Under this regime, depending on your profession, you are taxed on a percentage of your gross income.

The tax rates vary from 1 percent to 35 percent, with the most common rate being 25 percent. You don’t need to keep detailed accounting records, but you must issue invoices and keep a record of your income and expenses.

Organized Regime (Contabilidade Organizada):

This more complex accounting system requires you to keep detailed records of your income and expenses.

Under this regime, your taxable income is calculated by deducting your expenses from your gross income.

You are taxed at a progressive rate, which ranges from 14.5 percent to 48 percent, depending on your income level.

Here’s the comparison table of Simplified regime and Organized regime:

| Accounting Method | Description | Income Threshold | Tax Calculation | Tax Rate |

| Simplified Regime | A flat-rate tax system for self-employed workers with gross annual income less than €200,000. Taxed on a percentage of gross income. No need for detailed accounting records, but must issue invoices and keep a record of income and expenses. | less than €200,000 | Based on a percentage of gross income | 1% – 35% (commonly 25%) |

| Organized Regime | A more complex accounting system requires detailed records of income and expenses. Taxable income is calculated by deducting expenses from gross income. | N/A | Deducting expenses from gross income | Progressive (14.5% – 48%) |

Registering for Self-employed Tax in Portugal

If you’re starting your freelance activity in Portugal, the first step after compiling the documents is to go to a local tax office or do it yourself on the Portal das Finanças. Log into your account, and look for the Beginning of Activity button, which you’ll find by clicking on Services, and then on Activity.

Click on Deliver the Certificate and search Article 151 of the CIRS, as most freelance activities fall under this number. The certificate will ask you to include the start date of your activity, the amount you expect to earn between January and December, and your IBAN.

The next step is to choose between the simplified and organized regimes discussed above.

Keep in mind that you’ll be required to hire an accountant if you select the latter, as this means you’re operating like a company.

Once you open your activity, you will receive a paper from Finances at your home address confirming the beginning of your freelance activity. This document typically arrives in 7-14 days.

VAT options for freelancers

Another thing worth mentioning is that there are two VAT options for freelancers in Portugal:

- regime de isençao (exemption regime)

- regime normal (regular regime).

You can enjoy the first option if you have a turnover of €12,500 or less on taxable goods and services.

If you’re required to charge your clients IVA, you must submit an online declaration to the tax authorities every three months.

When Do Self-Employed Workers File for Taxes in Portugal?

The first day of January is also the start of a tax year in Portugal and lasts until December 31. You should file your taxes using Portal das Finanças between April 1 and June 30.

Freelancers and independent workers in Portugal can pay taxes in 3 installments – July, September, and December.

Self-employed Tax Fines in Portugal

Self-employed workers in Portugal are subject to tax fines if they fail to comply with tax obligations or submit inaccurate or incomplete tax returns. These financial penalties start at €200 and go up to €2,500.

For example, if you fail to file your tax return by the deadline, you might face a penalty of up to 10 percent of the tax owed. If the return is submitted with errors or omissions, the penalty can be up to 30 percent of the tax owed.

Tax Deductions and Credits for Self-employed Workers in Portugal

As a self-employed freelancer in Portugal, you can take advantage of tax deductions and credits to reduce your tax liability, as these encourage entrepreneurship and stimulate economic growth. You can deduct expenses related to their business activities, such as rent, utilities, office supplies, and travel expenses.

You can benefit from tax credits for certain expenses, such as research and development, energy efficiency, and environmental protection. Moreover, you can deduct contributions to social security and health insurance, as well as expenses related to training and education.

Social Security for Self-employed Workers in Portugal

Independent workers, including freelancers, must manage their own social security contributions. You pay it through Segurança Social, and the amount depends on your earnings, but the usual rate is 21.4 percent.

Each month, you must pay your social security until day 20. In return, you’re entitled to regular employee benefits, including parental leave, unemployment allowance, and pension fund.

However, independent workers are exempt from paying social security during the first 12 months. – If you opened your freelance activity in January 2023, Social Security would start charging you in February 2024.

How to Benefit from NHR While Self-employed

Every freelancer who meets the requirements can benefit from the Non-Habitual Resident (NHR) tax regime. The criteria you must meet to be eligible for NHR are:

- Be a tax resident in Portugal who spends at least 183 days per year in the country.

- Be registered as a freelancer in Portugal and conduct your business operations here.

- Have a high-value activity, meaning you must have highly specialized knowledge or skills. Some examples are architects, engineers, singers, and medics, but you can check the list of all high-value activities making you eligible for NHR.

- You haven’t been a tax resident in the past five years.

If you acquire the NHR tax status, you will pay a 20 percent flat rate on IRS.

Finding an Accountant or Financial Advisor in Portugal

If your accounting method requires having an accountant, or you prefer to remove this stress and have a professional do your taxes, you can research local accountants online and highlight in your search that you are looking for those speaking English. You can even look them up on LinkedIn or reach out to us for recommendations.

Conclusion

Registering as a freelancer and filing your taxes in Portugal can be daunting, especially if you’re new to the country. However, our guide will help you ensure you’re on track with all the steps and that you aren’t missing out on anything.

Helpful Resources for Self-employed Workers in Portugal

- Autoridade Tributária e Aduaneira – the Portuguese TaxAuthority

- Segurança Social – Portuguese Social Security

- ePortugal – Citizen’s Portal

- Ordem dos Contabilistas Certificados – CertifiedAccountants in Portugal