If I Get a NIF from Novomove, Does That Mean I Have to Start Filing Taxes in Portugal?

When you obtain a NIF from us, it will initially be issued with a “non-resident” tax status.

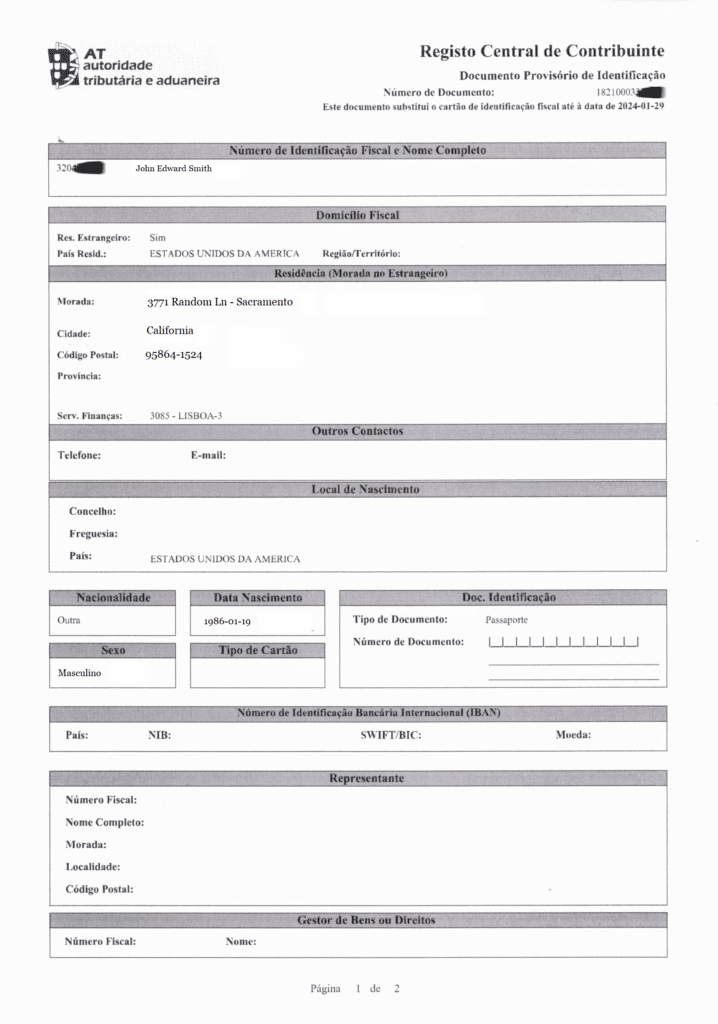

Here’s an example of an NIF document that we’ve provided to one of our clients.

In the section labeled “Domicílio Fiscal,” you’ll notice a line that says “Res. Estrangeiro,” with the word “Sim” next to it. This simply confirms that the individual is considered a foreign resident in the eyes of the Portuguese tax system, meaning they have a non-resident tax status.

NIF example:

The non-resident status is particularly beneficial because it doesn’t automatically subject you to Portugal’s income tax system for your global income.

Here’s a breakdown of what taxes you’ll need to pay in a “non-resident” tax status in Portugal:

Income Sourced in Portugal

As a non-resident, you will only be taxed on income that is sourced in Portugal. In other words, if you don’t work in Portugal and all your income is generated abroad, you won’t need to file an income tax return in Portugal.

Vehicle Taxes

If you own a car in Portugal, you’ll need to pay the Imposto Único de Circulação (IUC), or Vehicle Circulation Tax. This is an annual tax and varies depending on the type of vehicle, its age, and emissions. The tax is not exceedingly high (around 150-300 eur/year) but is something to consider if you’re thinking of having a car in the country.

Property Taxes

For those who own property in Portugal, there’s the Imposto Municipal sobre Imóveis (IMI), or Municipal Property Tax, that must be paid annually. The rate varies between 0.3% and 0.8% of the property’s fiscal value, which is usually less than the market value.

Anything Else?

Well, there are some specialized cases where you might encounter other forms of taxation as a non-resident:

- Capital Gains: If you sell a property in Portugal, you might be liable for capital gains tax.

- Tourist Rentals: If you own a property and decide to lease it out to tourists, you’ll have to pay tax on that income.

- Inheritance and Gifts: Portugal also has an Imposto do Selo, or Stamp Duty, applicable on inheritances and gifts. However, close family members are generally exempt.

Transitioning from Non-Resident to Resident Tax Status

Getting your NIF with a non-resident status is relatively straightforward, but changing it to a resident status isn’t automatic and comes with its own set of complications.

Many people assume that the mere act of living in Portugal for a certain amount of time, or even obtaining a residency permit, will automatically shift their tax status from non-resident to resident. This is not the case.

The Process of Status Change

To officially change your tax status from non-resident to resident, you must take deliberate steps.

First, you will need to prove that you genuinely reside in Portugal. This proof usually comes in the form of a lease agreement or proof of property ownership. Simply having a residency permit or spending significant time in the country doesn’t automatically change your tax status from a non-resident to a resident one.

Once you have your proof, the next step involves formally requesting a change of status. This is done by logging onto the Autoridade Tributária e Aduaneira (the Tax and Customs Authority) portal, often referred to as the Finanças portal. You must upload the necessary documents and file a request for your tax status to be updated from non-resident to resident. The process can take some time, and it’s advisable to check regularly to confirm the update has been made.

You can check our guide on How to Update Your Portugal NIF Address on Portal das here Finanças here

Tax Implications of Resident Status

Only after this formal change in status will you be subject to Portuguese income tax on your global income. As a tax resident, you are obligated to declare all forms of income, whether they are generated within Portugal or internationally. It means filing an annual income tax return that includes income such as salary, dividends, and even capital gains. In essence, the stakes are higher, and the tax implications are broader, once you switch to a resident tax status.

Important to Note

It’s also worth mentioning that failing to make this formal change while living in Portugal could expose you to back taxes and potential penalties if the authorities determine you should have been paying taxes as a resident.

Summary

Getting a NIF doesn’t automatically subject you to filing income taxes in Portugal, especially if you’re a non-resident.

You’ll only be responsible for specific types of taxes related to assets or income in Portugal.