How to Update Your Portugal NIF Address on Portal das Finanças

Recently moved to Portugal? You may need to update your Portugal NIF (Número de Identificação Fiscal) address on Portal das Finanças.

We’ll guide both EU/EEA area residents and non-EU/EEA residents, whether or not they have a tax representative. Let’s get started.

Scenario 1: Updating address if you don’t have a tax representative on your NIF

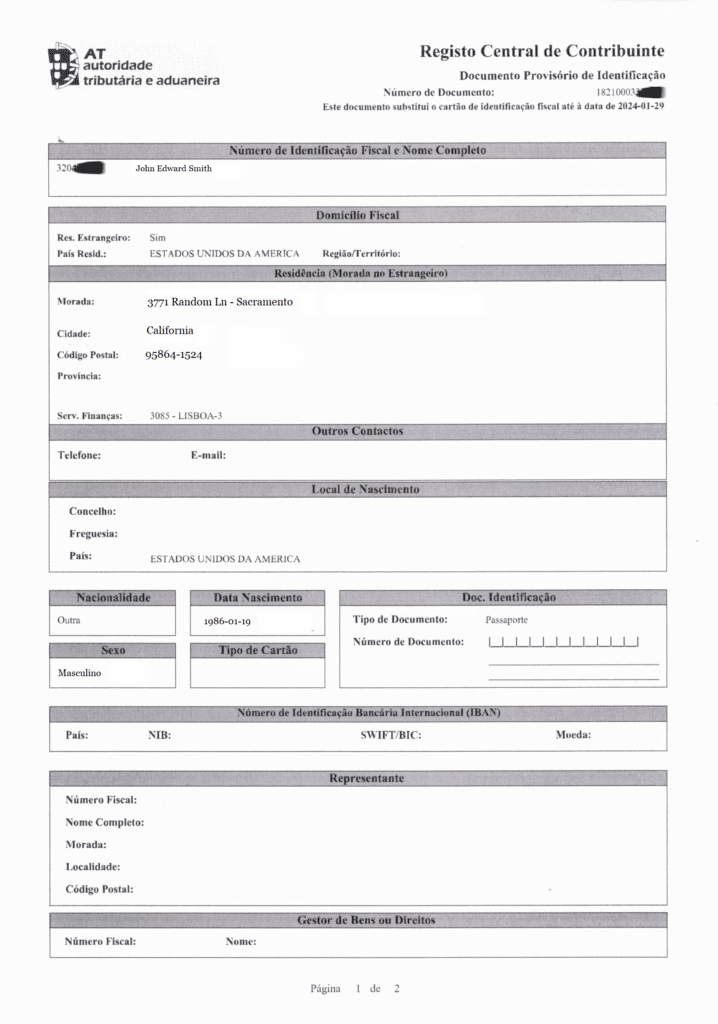

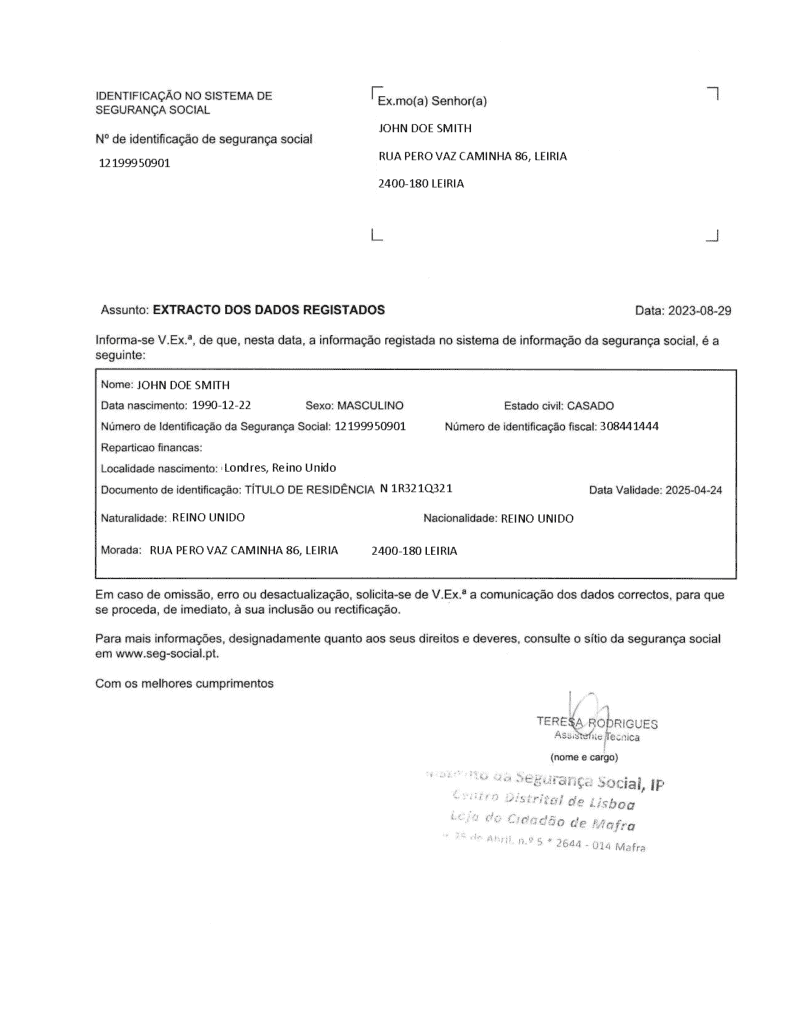

This method will work for people with Portuguese resident permits (for non-EU countries) and CRUE (for EU residents) who don’t have a tax representative in your NIF (see the example below).

Let’s start by ensuring you have everything you need:

- Portuguese NIF

- Portal das Finanças password

- A valid proof of address (see the list below)

Valid Documents for Proof of Address:

- Portuguese residence permit (for Non-European citizens residing in Portugal)

- Certificate of residency (for EU / EEA citizens residing in Portugal)

- EU / EEA Residence card (for EU / EEA citizens of all nationalities residing in Portugal)

- EU / EEA Driver’s license (for EU / EEA citizens of all nationalities residing in Portugal)

- First page of bank statement issued within past 3 months (for EU / EEA citizens of all nationalities residing in Portugal)

Step 1: Logging in to Portal das Finanças

1. Navigate to https://www.portaldasfinancas.gov.pt/ and click on “Iniciar Sessão” at the top right corner.

2. Select the NIF tab and enter your NIF number and password. Then click “Autenticar” to proceed.

Step 2: Navigating to e-balcão

1. Use the search bar to find “e-balcão.”

2. Click on “Atendimento e-Balcão” and then “Aceder“.

Step 3: Registering a new request

1. Click on “Registar Nova Questão” button under the “Pedido de Informações / Esclarecimentos” section.

2. Choose the options from the dropdown menus as in the example below:

3. Respond “No” to the question, “Alguma destas responde às suas dúvidas?”

4. Fill out the form with the provided text, replacing the placeholders with your information.

| Field | Text to paste | Translation |

| Assunto | Alteração de morada | Change of address |

| Mensagem | Boa tarde, Venho por este meio solicitar a alteração da minha morada. A minha morada actual é: [your complete address in Portugal]. Obrigado/a pela vossa ajuda! Cumprimentos, [Your name] | Hello, I request a change of my current address. My current address is: [your address in Portugal including your parish]. I appreciate your help! Regards, [Your name] |

5. Attach your proof of address by clicking the Procurar button. Next, click the Register Questão button to submit your request.

Wait for a couple of business days before moving to the next step.

Step 4: Sign and upload the Alteração document (optionally)

Please be aware that the tax office may skip this step. If you do not receive an Alteração document, go to the next step.

1. Log in to the Portal das Finanças (refer to Step 1).

2. Go to e-balcão (refer to Step 2).

3. In Interações Registadas, choose your message thread and click the “Ver Pedido” button.

4. Look for a message from Autoridade Tributária containing a document labeled Alteração (“change”) or with the tag “alt”.

5. Download the Alteração document and follow these steps:

- Ensure all information is correct.

- Sign and date the document (see the example below).

6. Attach the signed Alteração document and reply to the thread with the message: “Veja o documento assinado em anexo” (See signed document attached).

Wait 1-2 business days before proceeding to the next step.

Scenario 2: Updating address with a tax representative (for non-EU/EEA residents)

The process is slightly different if you have a tax representative. Here’s what you need to do:

Step 1: Logging in to Portal das Finanças and navigating to e-balcão

1. Follow 1-2 steps on the Scenario 1.

Step 2: Registering a new request

1. Click on “Registar Nova Questão” button under the “Pedido de Informações / Esclarecimentos” section.

2. Select the following options from the dropdown menu:

3. Choose “No” for the question, “Alguma destas responde às suas dúvidas?”

4. Complete the form with the provided text, replacing the placeholders with your information:

| Field | Text to paste | Translation |

| Assunto | Alteração de morada e cancelamento de representação fiscal | Change of address and cancellation of fiscal representation |

| Mensagem | Boa tarde, Venho por este meio solicitar a alteração da minha morada. A minha morada actual é: [your complete address in Portugal]. Solicito também o cancelamento da representação fiscal de [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] tendo em conta a minha morada em Portugal. Obrigado/a pela vossa ajuda! Cumprimentos, [Your name] | Hello, I request a change of my current address. My current address is: [your address in Portugal including your parish]. I also request the cancellation of the tax representation by [your fiscal representative’s name] – NIF [your fiscal representative’s NIF] in place of my Portuguese address. I appreciate your help! Regards, [Your name] |

5. Attach your proof of address by clicking the Procurar button and then click the Registar Questão button to submit your request.

6. Wait for 1-2 business days for processing.

7. If you do not receive an Alteração document, proceed to the Step 4 of the scenario 1.

Scenario 3: Updating address before receiving your Portuguese residence permit

Are you a non-EU citizen who wants to update your NIF address in Portugal but hasn’t received your Portuguese residence permit yet?

While the Portuguese residence permit is typically the primary proof of address accepted by authorities, you can try to update your NIF address sooner than receiving the residence.

Please note: There’s no guarantee of success with this method. However, it’s worth trying if you need to update your NIF address urgently.

Here’s a short guide to help you through the process:

Follow the requirements in Scenario 1, except instead of a Portuguese residency, upload the following documents as proof of address:

- Certificate of Residence: Obtain a Certificate of Residence (“Atestado de residência”) from your local Parish (“Junta de Freguesia”). This document serves as proof of your address in Portugal.

- Additional Documents: Along with the Certificate of Residence, you will need to submit either:

- Confirmation of your AIMA (formerly SEF) appointment

- Receipt provided by AIMA (formerly SEF) on your appointment day.

Now you can easily change the address in your NIF by following our step-by-step instructions and ensuring you have the necessary documents, regardless of whether you have a tax representative.

Got a question? Feel free to leave it in the comments section below.