How to Apply for Portugal’s NHR Tax Regime

Want to take advantage of the tax breaks and warm weather in Portugal? Portugal’s Non-Habitual Residence (NHR) tax regime might just be just for you.

NHR provides tax breaks to both new and returning residents over a generous 10-year term. And the best part? You can apply for it easily through Portugal’s tax office website, Portal das Finanças.

However, last year there were some updates on the regime, so make sure you check out our guide on NHR in 2024.

Now, before we get into the details, let’s make sure you check all the boxes:

- You’re a Portuguese tax resident. Not there yet? No worries, just take the necessary steps to become one.

- You have the legal right to reside in Portugal.

- You haven’t been a Portuguese tax resident in the past five years.

Alright, now let’s gather our tools. You’ll need:

- Your NIF number and password for Portal das Finanças.

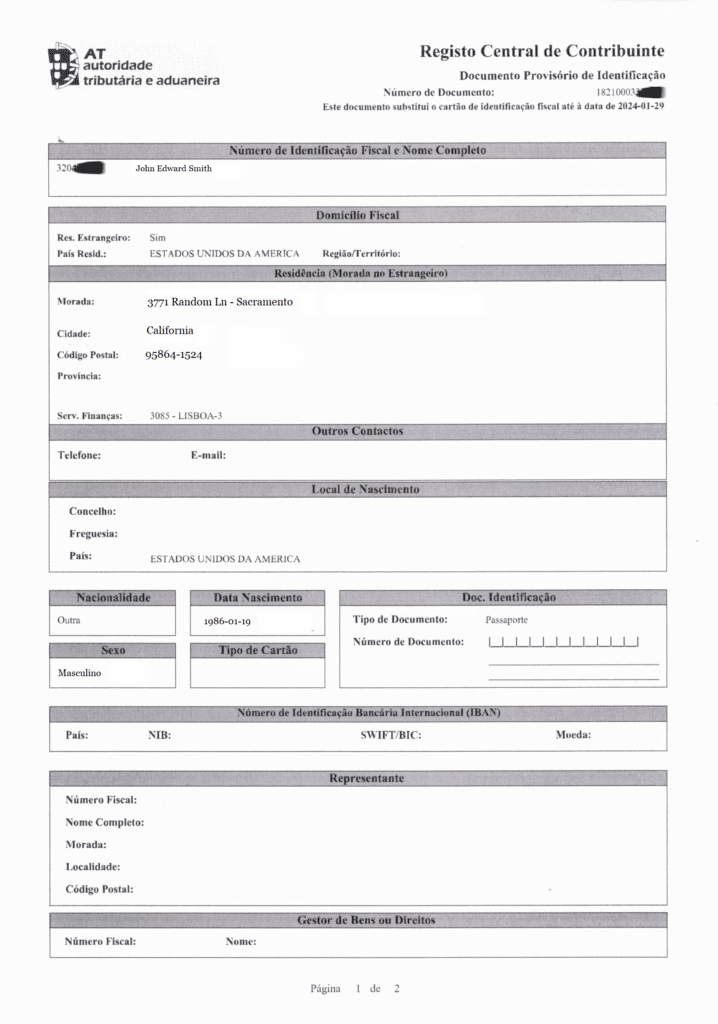

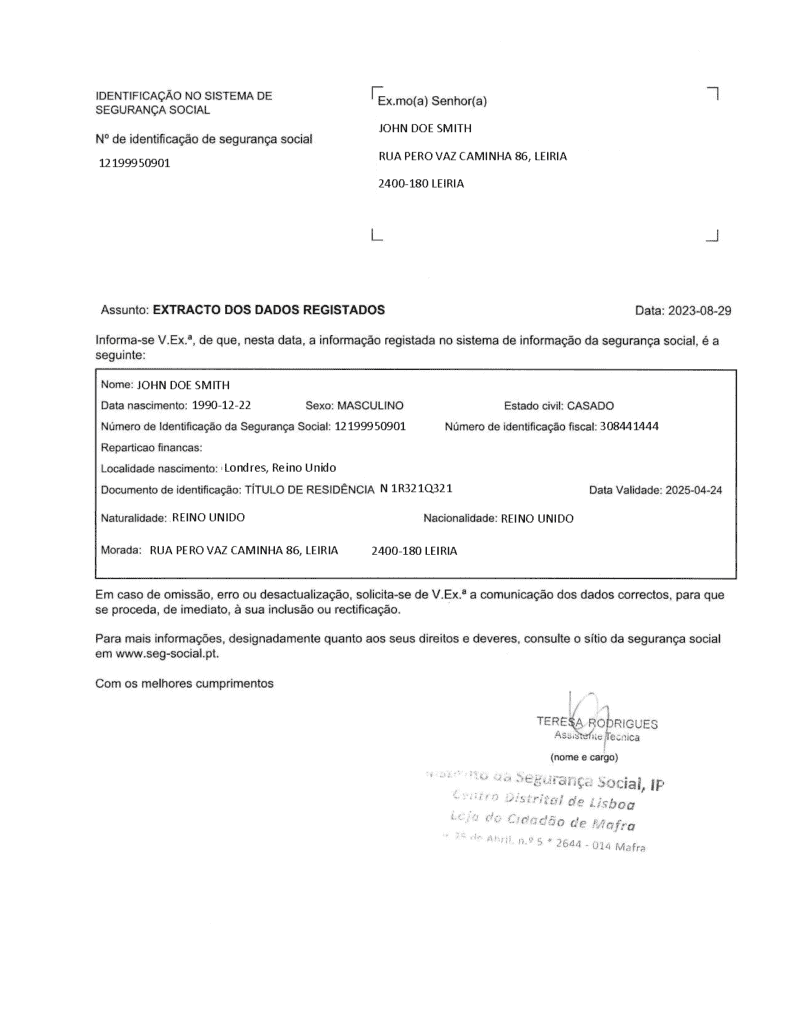

- Your Portugal NIF has been updated with a Portuguese address. Here is how you can do it.

Step 1: Log In to Portal das Finanças

1. Head over to https://www.portaldasfinancas.gov.pt/

2. To start a session, click the “Iniciar Sessão” button in the upper right corner.

3. Select the “NIF” tab.

4. Enter your NIF number along with the password.

5. Hit the “Autenticar” button, and you’re in!

Step 2: Let’s head to the NHR section

1. Write “residente não habitual” into the search bar at the top.

2. Find “Residente Não Habitual” and click the “Aceder” button next.

Step 3: Time to submit your NHR request

1. Hit the “Entregar Pedido” button.

2. Verify your address. If it checks out, you’re good to go! Found a mistake? Speak with the Tax Office.

3. Next, fill in the required fields under “Dados do Pedido“:

- “Ano de início” – You should indicate the year that you moved the residence to Portugal

- “País de Residência Estrangeiro” – You should indicate the last country of your residence

- If you do not have a tax representative acting on your behalf for the NHR application leave the “NIF Mandatário” field blank.

- Click on “Declaro, sob compromisso de honra, que reúno os requisitos para ser considerado

não residente nos cinco anos anteriores ao ano pretendido para o início do estatuto não

habitual. As falsas declarações são puníveis nos termos da lei.” - Click “Submeter” to send off your request.

5. Don’t forget to click “Exportar” to save a copy of the confirmation.

Now, wait for 1-2 business days before moving on.

Step 4: Get your NHR Registration Document:

1. Log back into Portal das Finanças: https://www.portaldasfinancas.gov.pt/

2. Search for “residente não habitual (remember Step 2?).

3. Click “Consultar Pedido” this time.

3. Find your request and confirm that your NHR status is “Deferido” and next click the search icon under “Detalhe“.

4. Once the new page loads, tap the “Comprovativo” button at the bottom.

5. Your NHR registration document is ready for download! Here is an example for your reference.

Congratulations, you’ve successfully navigated the maze of bureaucracy and secured your NHR! If you have any questions, please ask them in the comments section below.