How to Apply for Portugal’s NHR Tax Regime

Want to take advantage of the tax breaks and warm weather in Portugal? Portugal’s Non-Habitual Residence (NHR) tax regime might…

Want to take advantage of the tax breaks and warm weather in Portugal? Portugal’s Non-Habitual Residence (NHR) tax regime might…

Once you’ve initiated the process to update your NIF address and remove your fiscal representative, the tax office typically issues…

Accessing your Segurança Social personal account for the first time is straightforward. If you don’t already have a password, here’s…

Once you receive your password for Portal das Finanças, it’s essential to log in and update it to something known…

Recently moved to Portugal? You may need to update your Portugal NIF (Número de Identificação Fiscal) address on Portal das…

In 2022, Portugal changed its fiscal representation rules. These updates offer significant benefits to non-residents, particularly those outside the EU/EEA….

In this 5-step guide, we’ll walk you through the simple steps to ensure your email is confirmed on the Portal…

Chave Digital, also known as Chave Móvel Digital, is an initiative in Portugal aimed at facilitating a digital signature system….

See the additional requirements below:

You will need to provide a copy of your Portuguese birth certificate or your Citizen Card (Portuguese: Cartão de cidadão).

When ordering your NIF, you will need to provide proof of address that satisfies the following criteria:

If purchasing NIF only

*Schengen Areas:

Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Image quality

Acceptable Documents

Any of the following documents are acceptable:

1.Driver’s license

2. First page of bank statement

Utility bill

For Minors

If requesting a NIF on behalf of a minor, please include a proof of address of one of the minor’s parents.

In the event that we’re unable to successfully open your bank account, we implement our ‘No Win, No Fee’ Guarantee.

This means we will refund 50% of the total service cost, which equates to the Success Fee.

Process Fee: 50% of the total payment, this fee covers the administrative tasks and processes involved in submitting your application.

Success Fee: The remaining 50% of the total payment, this fee is charged for the successful opening of your bank account.

It’s important to clarify that this guarantee does not cover any potential initial deposit or the bank’s recurring monthly fees.

Our guarantee ensures that if we don’t succeed in our primary service – opening your bank account – you aren’t charged the full service fee.

This policy showcases our confidence in our services and our dedication to customer satisfaction.

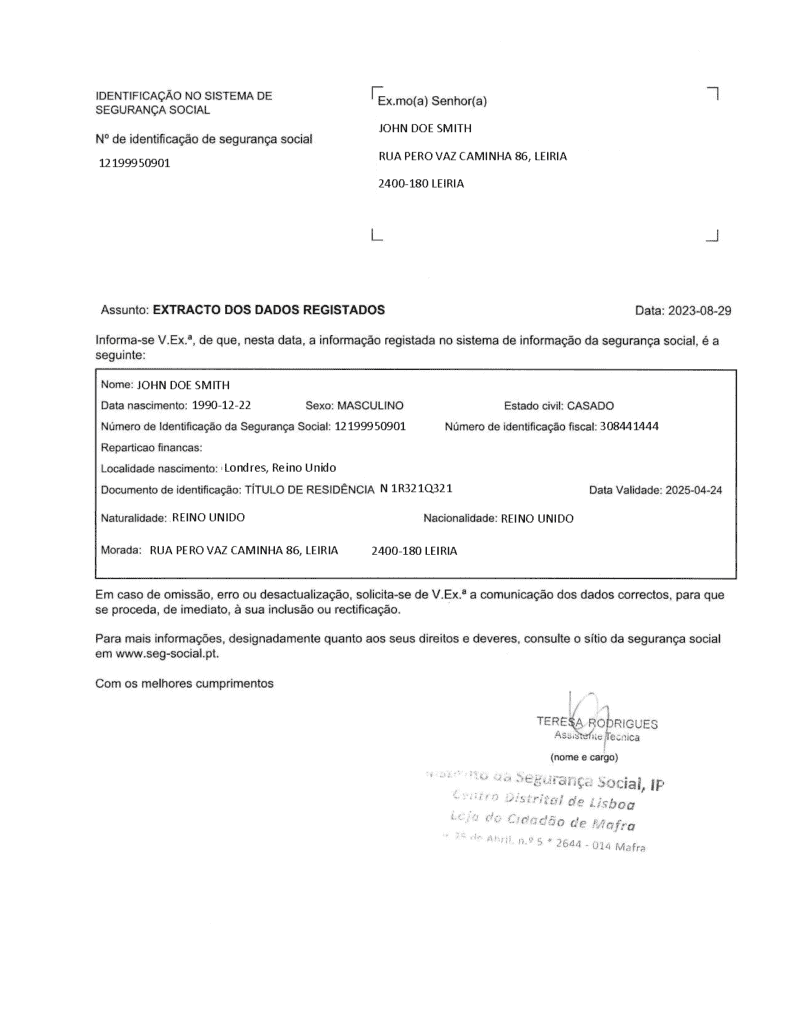

This is an example of a NISS pdf we provided to a client from the U.K.

Please note that name and address have been edited for privacy purposes.

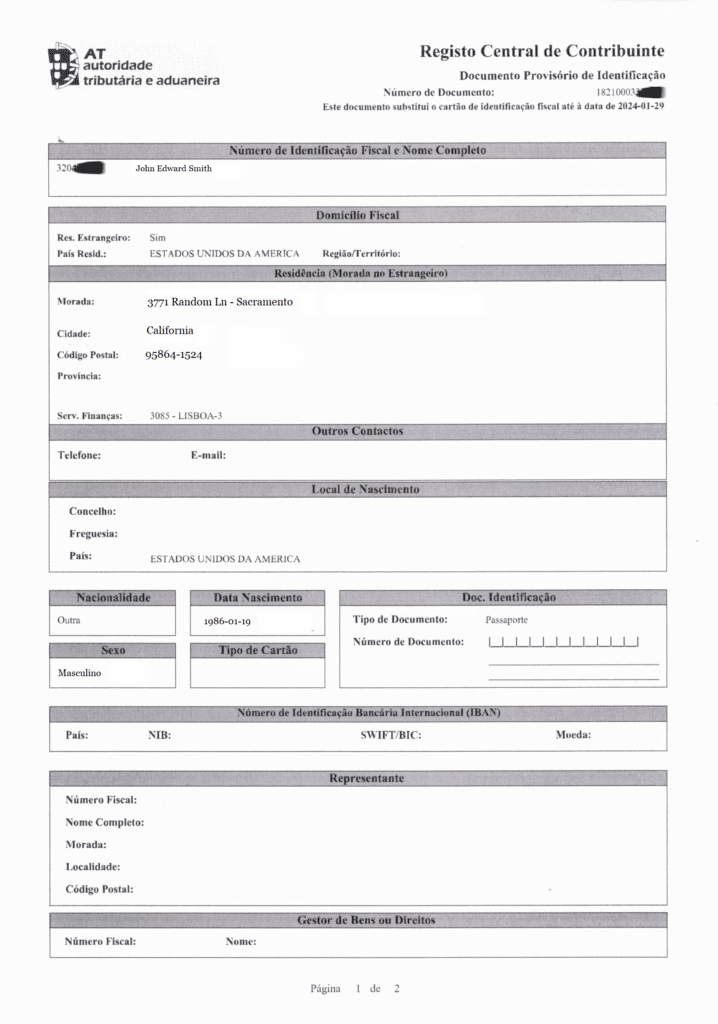

This is an example of a NISS document we provided to a client.

Please note that name and address have been edited for privacy purposes.