ActivoBank Review: Your Guide to Free Banking in Portugal

No matter how much you enjoy that “everyone smiles in the same language”, you will still need a Portuguese bank for the magic of your expat wanderlust.

My journey began in mid-October 2022 when I moved to Portugal from Madrid (Spain) with my husband.

As part of our research on banking options in Portugal, we heavily relied on other expats’ experiences and recommendations, which ultimately led us to discover ActivoBank.

In this ActivoBank review, we’ll share our insights and experiences, shedding light on account features, services, and how it simplifies banking for expats like us.

Pros and Cons of Activobank

I will start with a list of pros and cons for you to consider before you make it rain (or not) with your hard-earned expat money at ActivoBank.

Pros:

- No maintenance fees for the Simple Account and free Visa debit and credit cards

- ActivoBank is part of the Millennium BCP group, the largest listed bank in Portugal with over 2.5 million customers and a market share of roughly 20%, offering security for customers

- ActivoBank offers a range of savings and investment products with competitive pricing

- ActivoBank offers innovative and simple banking services with a modern and user-friendly website and mobile app

- ActivoBank’s Visa debit card can be used to withdraw money from any ATM in Portugal without incurring any fees, thanks to the integrated Multibanco Automatic Payment (one of the most modern systems in Europe)

- A special account designed for kids with no fees and free debit and pre-paid cards

- Friendly personnel with good English level both at the offices and over the phone

- Flexible schedule at the bank offices

Cons:

- Customer service may be difficult to reach and not very helpful according to complaints registered at Deco Proteste

- Some customers have reported unexpected charges and fees on their accounts

- Unclear and unattractive CDs rates

- Unclear daily limits and related fees for international wire transfers

- ActivoBank’s plans which combine various banking services and products, provide customers with options that are not easy to evaluate.

- Limited physical branch network

- Lack of personalized services compared to traditional banks

- Limited range of financial products and services compared to larger banks

How And Why ActivoBank Became My Bank in Portugal

Since we were already clients of Banco Santander in Spain, my husband and I decided to open bank accounts with Santander Totta during our second scouting trip. Our primary goal was to have a bank account that would facilitate our home purchase.

While our initial experience with Banco Santander in Portugal was positive, we were not satisfied with the monthly fees. As we settled into our new life, we needed a more suitable banking solution.

After some internet searches, I learned that:

- ActivoBank was chosen as the best bank in Portugal by Deco Proteste (the largest consumer defense organization in the country) due to high levels of customer satisfaction and product quality.

- There are no commissions on checking accounts. It is, as far as I know, the only online Portuguese bank where expats can open a checking account completely free of maintenance fees.

- Most of the content on the website is available in English.

- ActivoBank is, like any other European Union commercial bank, part of the EU deposit guarantee scheme. This scheme protects savings by guaranteeing deposits of up to €100,000 to compensate depositors whose bank has failed.

ActivoBank’s History and Background

ActivoBank’s origins can be traced back to 1994 when Banco 7 was established by Millennium Banco Comercial Português (Millennium BCP) as an innovation lab. Its primary objective was to explore and implement pioneering and cost-efficient alternative distribution channels.

During the 2008 financial crisis, ActivoBank7 (the successor of Banco7) faced challenges because its customer base was affected by economic turmoil. Besides, the institution suffered from a lack of diversification and a reduction in core operations.

In this context, Millennium BCP developed a strategy to target younger generations. The goal was to address the issues of its aging client base and ActivoBank7’s situation at the same time. The solution was to provide a self-directed banking experience driven by technology and innovation, which led to the creation of ActivoBank in 2010 (Valbordo Carvalho, 2015).

ActivoBank’s Products: Checking Accounts, Plans, and Financial Products

Checking Accounts

ActivoBank has two types of checking accounts:

- Simple account: This is probably the account that best fits your expat financial needs: no maintenance fees and free Visa debit and credit cards.

- Minor account: A special account designed exclusively for kids, with no fees, a free debit card available from the age of 14, and a free pre-paid card from the age of 10.

The ActivoBank Visa debit card can be used to withdraw money from any ATM in Portugal without incurring any fees, thanks to the integrated Multibanco Automatic Payment, which is one of the most modern systems in Europe.

International wire transfers are often necessary for the expat community, and my experience with ActivoBank’s transfers to a Spanish bank has been mixed. Wire transfers below 7,000 euros within the euro area are commission-free and hassle-free. However, complications arise when exceeding the unspecified daily limit.

Unlike Spanish banks, ActivoBank does not provide a constant daily limit for wire transfers, and customers must call to speak to an agent to determine the limit. If the transfer amount exceeds the daily limit, a fee is charged, which is an inconvenience that I did not experience at Santander Totta.

This uncertainty can be problematic for customers who need to make frequent wire transfers of varying amounts. Additionally, the information about wire transfer fees on ActivoBank’s website is also unclear.

AB Plus and AB Premium Plans vs Simple Account

In addition to its accounts, ActivoBank offers two plans that combine various banking services and products: AB Plus and AB Premium. These are similar to gym or telephone company plans, providing customers with options that are not easy to evaluate.

Feature | Simple Account | AB Plus | AB Premium |

Monthly Fee (Account Maintenance Fee) | 0€ | 3,99€ | 8,99€ |

Ordenado Activo with Reduced Rate* | - | (4,89€) ✓ | (4,89€) ✓ |

Personal Loan without Loan Opening Fee | - | (4,17€) ✓ | (4,17€) ✓ |

Cashback on Household Expenses | - | 2% (2€) ✓ | 3% (6€) ✓ |

Instant Transfers per Month | - | 3 (4,5€) ✓ | 5 (7,5€) ✓ |

Stock Market Orders per Month | - | (6,5€) ✓ | 2 (13€) ✓ |

Safekeeping of Securities | - | 1,67€ ✓ | 1,67€ ✓ |

Pet Civil Liability Insurance | - | 3,33€ ✓ | 3,33€ ✓ |

Family Civil Liability Insurance | - | 2,92€ ✓ | 2,92€ ✓ |

Medical Emergency Assistance at Home | - | - | 3,75€ ✓ |

AB Gold Credit Card | - | - | 2,99€ ✓ |

Total Costs without Plan | - | 33,98€ ✓ | 60,22€ ✓ |

Save up to | - | 25,99€ ✓ | 41,23€ ✓ |

Extra Touch | - | AB Plus Term Deposit (TANB 1,50% TANL 1,08%) & 4€ on Galp fuel ✓ | AB Premium Term Deposit (TANB 1,75% TANL 1,26%), Priority in support line & ActivoBank branches, 10€ on Galp fuel ✓ |

Debit Card Provision Fee | 0€ | 0€ | 0€ |

Free of Charge SEPA Transfers | (Up to 12,500€ limit) ✓ | ✓ | ✓ |

MBWAY Free of Charge | ✓ | ✓ | ✓ |

Debit, Credit Classic, and Pre-paid Cards without Cost | (TAEG 15,0% TAN 13,700%) ✓ | - | - |

*Rates for Ordenado Activo with Reduced Rate: TAN 9,000% | TAEG 9,8%

Savings and Investment Products

ActivoBank offers a range of savings and investment products that are similar to those offered by other online institutions, including deposits, investment funds, ETFs, stocks, bonds, and pension plans. These products are presented on their website with a modern approach that emphasizes simplicity and competitive pricing.

Some customers may prefer a more detailed and technical approach to financial products. As someone from Generation X, I find diagrams and statistics more helpful than blurbs and icons but, hey, I am not paying any maintenance fees on my account nor on my cards!

Given the current climate of increasing interest rates, risk-averse expats may find certificates of deposit (CDs) to be a particularly appealing financial option.

In Portugal, however, CD rates in 2023 are notably lower when compared to rates offered in Ireland, Italy, and Spain. ActivoBank does not enable you to check the deposits’ rates online if you are not a client, something that is uncommon in standard online banking practices.

If you are part of Portugal’s NHR program, keep in mind that returns on CDs will be subject to taxes, making it worthwhile to explore other euro area countries for better after-tax rates.

Account Opening Process and Customer Service

According to ActivoBank’s website, the simple account can be opened with a €500 deposit at a branch or €100 online. However, expats may encounter difficulties when opening an account online. See below. Even though I already had my Chave Móvel Digital, an authentication and digital signature service certified by the Portuguese Government, I was not able to open my account online.

My advice is that you plan ahead, as you will most likely need to visit one of their offices.

Unfortunately, the limited number of branches and long queues may cause some frustration. As of April 2023, ActivoBank has offices in several cities throughout Portugal, including Aveiro, Braga, Coimbra, Leiria, Lisbon, and Porto.

What follows is a step-by-step guide on how to open up your checking account at ActivoBank as an expat.

Keep in mind that I opened my account in February of 2023, right after the January change in regulations to clamp down on money laundering. Reviews written before January 2023 might be outdated due to this change.

- Call all on the phone (+351 800 913 700) just to make sure that your expat/work situation requires an in-person meeting to open the account.

- If you are seeking a Portuguese residency visa (such as the D7) and need to open an account before relocating, it is worth checking one of the many Facebook expat groups in Portugal for up-to-date information. My preferred group is Americans & FriendsPT | Facebook.

- Check ActivoBank’s website to find the location closest to you. Offices open from 9 A.M to 8 P.M every day except Sunday.

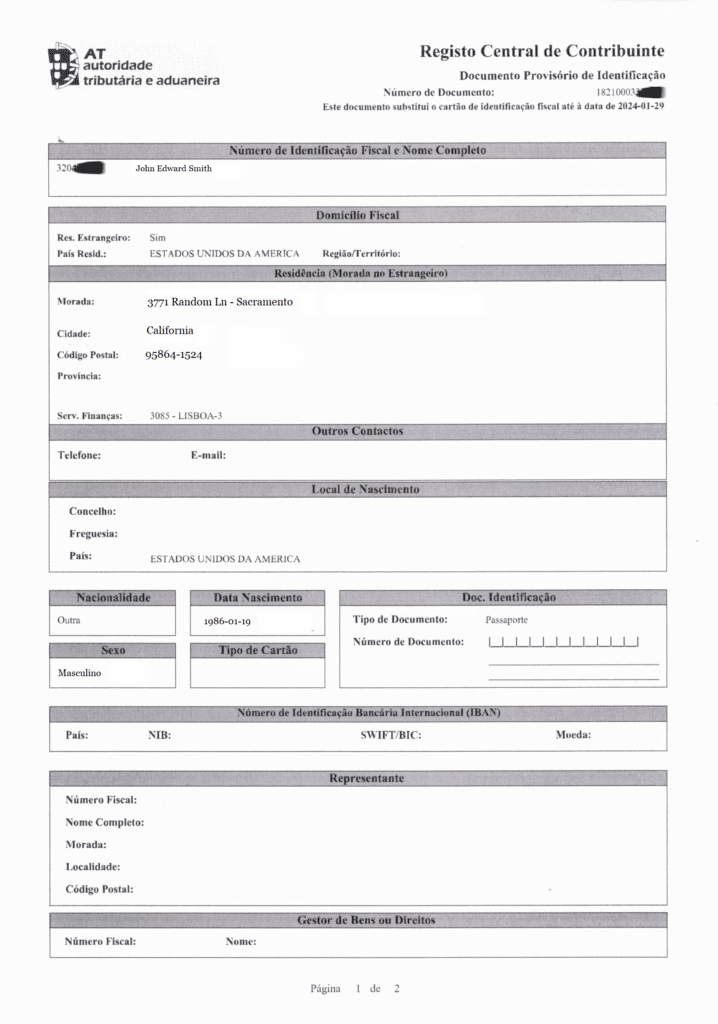

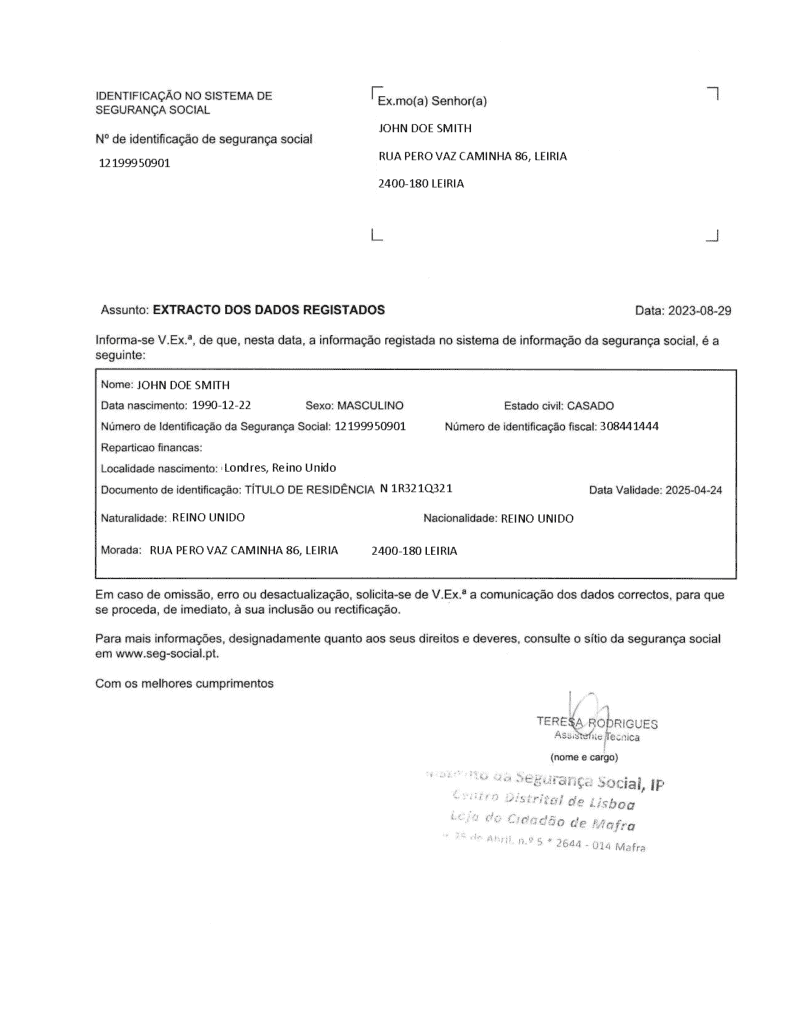

Have the following documents ready:

- Make plans to spend a few hours at the ActivoBank office or Ponto Activo.

- Upon arrival at the branch, you will need to take a senha (queue ticket) and wait for your turn, as is typical for many stand-in-line services in Portugal. It took us over an hour to complete the opening process for two accounts and receive our free cards.

- Verification of your information by bank personnel is a significant part of the account opening process, particularly if you have not lived in Portugal for the last 12 months, are not employed and/or receiving pension or social security payments.

- You will be e-signing around ten documents, which is the most exciting part because it indicates that you are almost done with the process.

- After you finish with the signatures, you will be directed to the ATM to set up your debit card.

- Transfer the €500 needed to activate your account.

Although the process took longer than anticipated, we were impressed with the friendly and efficient personnel who spoke excellent English. Considering that we left the Ponto Activo with our debit cards in hand, the experience was not too bad overall.

ActivoBank offers a notably flexible schedule for in-person services (offices are open from 9 A.M to 8 P.M every day except Sunday) and longer than the operating hours of most other banks in Portugal. The phone support line is available every day, including Sundays and holidays, with a highly flexible schedule. In my brief experience, waiting time on the phone has not been an issue.

Additionally, the automated service and card emergency services are available 24/7, every day of the week.

ActivoBank Mobile App and Website: Main Features and Security

ActivoBank was primarily designed to function as an online and mobile banking institution, with their mobile app playing a crucial role in their overall strategy. I have found the app to be just convenient, featuring a user-friendly interface and no issues with fingerprint login thus far.

While certain sections of the app are in Portuguese, I have encountered this language gap frequently in my online experiences, and consider it an opportunity to learn and explore. Security should not be an issue when buying online as the entire environment is 3D secure, allowing the customer to authenticate all of the online purchases.

3D secure is already active on the cards when you receive them and is associated with your contact at the bank. There are two methods of authentication: through a code sent by SMS and via the bank’s app. The authentication method requested in each purchase depends on the 3DS protocol used by the online store.

While I have confidence in ActivoBank’s digital security and safety measures, I do have one concern regarding the creation of online account passwords, which are currently limited to seven numbers.

In my opinion, this represents a potential security deficiency that could be easily addressed by allowing the use of combinations of numbers, letters, and special characters, as many password generator apps like Dashlane do.

Given that I use ActivoBank’s website more frequently than its mobile app, I decided to consult Trustpilot reviews online to evaluate the opinion on the app’s performance:

- Only a small number of customers who rated ActivoBank poorly (one star) complained about issues with the app’s functionality or features

- A significant number of those who gave the bank four or five stars praised the ActivoBank app.

How is ActivoBank Perceived By Its Customers?

The Deco Proteste reveals mixed feelings about ActivoBank. On the one hand, the bank has been awarded the title of “Best Bank in Portugal” for the second year running. However, the same consumer organization has also ranked ActivoBank as péssimo (terrible) in terms of customer service.

This ranking is objective as it is based on consumer complaints submitted through the platform. A search for complaints against other banks shows ActivoBank with 84 complaints and Novo Banco with 51. Caixa Geral de Depositos, for example, did not have any complaints.

According to the 2020 Banking Conduct Supervision Report prepared by the Bank of Portugal (the Portuguese Central Bank), ActivoBank received 0.74 complaints per 1,000 checking accounts Next on the list of the most complained-about banks in relation to deposits are Novo Banco and Banco CTT, both with 0.68 complaints.

Summary and Final Recommendations

Overall, ActivoBank offers a good banking solution for customers looking for a simple, unsophisticated, and cost-efficient banking experience.

As a day-to-day financial institution, I consider ActivoBank the best choice for expats in Portugal for three main reasons:

- No maintenance fee for accounts and cards

- Services in English both in-person and on the phone

- Simplicity

I hope that my insights into why “the bank that simplifies” was the right choice for me will help you make an informed decision about your own banking needs in Portugal. Remember that online banking reviews for expats in Portugal may be outdated due to regulatory changes adopted in January 2023.

I highly recommend that you check the latest information directly with financial institutions or in private expat Facebook groups.