Best Expat-Friendly Banks in Portugal: Comparing Top Financial Institutions

Are you looking for the best bank in Portugal for expats?

In this comprehensive guide, we’ll compare traditional banks, online banks, and key factors to consider when choosing the right bank for your needs. Read on to find the perfect banking solution for your life in Portugal.

Let’s dive in!

Key Takeaways About Banking in Portugal

Key Takeaways

- Expats have various banking options in Portugal, including traditional banks like Activobank, Millennium, Novo Banco, Santander, and BPI, as well as online banks such as Moey, Revolut, N26, and Wise.

- Each bank offers a unique set of services, fees, and customer experiences. It’s essential to compare options and choose a bank that aligns with your financial needs and preferences.

- Online banking options are popular among tech-savvy expats and those seeking a more convenient banking experience with lower fees and user-friendly platforms.

- When choosing a bank in Portugal, consider factors such as accessibility, fees, customer service, and the range of banking services offered.

- Different types of bank accounts in Portugal cater to various financial goals and needs, including minimum service accounts, current accounts, savings accounts, and investment accounts.

Best Banks for Expats in Portugal

Activobank

Activobank is a popular choice among expats looking for a reliable and modern banking experience in Portugal. Established in 2001, Activobank is a digital bank that operates entirely online, offering its customers a range of services, including savings accounts, checking accounts, credit cards, and loans. One of the main advantages of banking with Activobank is its easy-to-use and intuitive online platform, which allows users to manage their finances from anywhere in the world. Additionally, Activobank offers competitive interest rates and low fees, making it an attractive option for those looking to save money.

As a member of the Portuguese banking system, Activobank is regulated by Banco de Portugal, the country’s central bank. This means that the bank has to follow the same rules and laws as other banks in the country. This keeps its customers’ money safe and secure. To open an account in Activobank in Portugal, a minimum deposit of €500 is required if done in person, or a transfer of €100 from an existing account if done online.

Millenium

Millennium BCP, also known as Millennium, is one of the largest banks in Portugal and a popular choice for expats. The bank was founded in 1985 and is headquartered in Porto. It operates more than 600 branches throughout Portugal and has a significant presence in other countries such as Poland, Mozambique, and Angola. Millennium offers a range of banking services including current and savings accounts, mortgages, loans, insurance, and investment products.

Millennium is also known for its modern and easy-to-use internet banking tool, which lets customers access their accounts, move funds, pay fees, and handle their finances from anywhere in the world. The bank also has a banking app for mobile phones, which makes it even easier for expats who are always on the go.

Novobanco

Novo Banco is a Portuguese bank founded in August 2014 as part of the Bank of Portugal’s resolution of Banco Espírito Santo (BES), one of the largest private banks in Portugal. The bank’s main office is in Lisbon, and it has more than 400 branches all over Portugal. This makes it one of the biggest private banks in the country.

Novo Banco offers a range of banking services to its customers, including personal banking, business banking, wealth management, and investment services. The bank is known for its innovative digital solutions, making it a popular choice among expats and tech-savvy individuals. Novo Banco’s online banking platform is user-friendly and easy to navigate, providing customers with access to a range of services, including online banking, mobile banking, and digital payments.

Santander

Santander Totta is a popular bank in Portugal, particularly among expats. With more than 600 branches across the country, Santander Totta is one of the largest banks in Portugal, and it offers a wide range of services and products.

Santander Totta offers a variety of checking and savings accounts, credit cards, loans, and mortgages, with competitive interest rates and fees. The bank also offers online and mobile banking, so users can easily handle their money from anywhere in the world.

One of the key advantages of banking with Santander Totta is its global network.As part of the Santander Group, the bank has a strong influence in many countries, such as Spain, the United Kingdom, and the United States. This can be particularly useful for expats who need to transfer money internationally or who travel frequently.

BPI

BPI or Banco BPI is one of the leading banks in Portugal, with a long history of serving customers since its establishment in 1981. It is part of the CaixaBank group, which is one of the largest financial institutions in Spain.

BPI provides a wide range of services to both individuals and companies, including savings accounts, checking accounts, loans, credit cards, investment funds, and insurance. The bank has a strong presence throughout Portugal, with over 500 branches and more than 1,000 ATMs.

BPI also has a number of digital banking services, such as online banking, mobile banking, and a banking app that is just for that. Customers can easily handle their accounts and use a wide range of banking goods and services from anywhere, at any time, thanks to these services.

Best online banks in Portugal

Moey (from Caixa Agrícola)

Moey is an online bank that is relatively new to the Portuguese market, launched in 2019 by Caixa Agrícola, a cooperative bank in Portugal. As an online bank, it offers a range of digital services and financial products that cater to the modern lifestyle of its customers. It is particularly popular among younger generations who prefer to manage their finances through a digital platform.

One of the best things about Moey is how easy it is to get to. Customers can start an account and do all of their banking online, so they don’t have to go to a bank office. Opening an account is easy and clear, and you can use a video call to finish the process of proving who you are. Customers can also use a mobile app that works on both iOS and Android devices to get to their accounts.

Revolut

Revolut is a digital banking tool that is becoming more and more popular in Portugal, especially among young people. This mobile-based bank offers a variety of features and services, such as online banking, planning tools, investing choices, and a prepaid debit card that can be used anywhere in the world. One of the best things about Revolut is how easy it is to use. Customers can sign up for the service and control their accounts all from their phones.

Revolut offers a range of account types, including a free basic account, a premium account with additional perks such as travel insurance and cashback, and a metal account with even more features. Account opening is simple and can be done through the app, with no need to visit a branch. Revolut also boasts competitive exchange rates, making it an ideal choice for expats who frequently travel or make international payments.

N26

N26 is a digital bank that works in Portugal and all over Europe. It was started in Germany in 2013, and since then it has become known as one of the best online banks out there. N26 offers a variety of services, such as current accounts, credit cards, and business choices, which can all be reached quickly through its mobile app.

One of the main benefits of banking with N26 is its user-friendly interface, which is designed to be intuitive and easy to navigate. Customers can open an account online in minutes, and the mobile app provides access to all banking services, including payments, transfers, and account management. Additionally, N26 offers 24/7 customer support via chat or phone.

N26’s fees are competitive and transparent, with no hidden charges or fees. Account holders can benefit from free ATM withdrawals and no foreign transaction fees, making it an excellent choice for expats who frequently travel or make international transactions.

Wise

Wise (formerly known as TransferWise) is a UK-based online financial services provider that has been operating in Portugal since 2011. The company offers a range of services, including international money transfers, multi-currency accounts, and a debit card that allows users to spend money in different currencies at the real exchange rate.

One of the main advantages of using Wise in Portugal is the low fees charged for international money transfers. Wise uses mid-market exchange rates, which are the rates that banks use to trade currencies with each other. This means that users can avoid the high exchange rate fees that are typically charged by traditional banks. Additionally, Wise charges a transparent fee for each transfer, which is often lower than the fees charged by banks.

Wise also offers a multi-currency account that allows users to hold and manage money in multiple currencies, including Euros, US Dollars, British Pounds, and more. Users can also apply for a Wise debit card that allows them to spend money in different currencies at the real exchange rate. The card has no annual fees, and users can withdraw up to €200 per month from ATMs without incurring additional fees.

Factors to consider when choosing a bank in Portugal as an expat

As an expat, choosing the right bank in Portugal can be a daunting task. There are several factors that you need to consider before making a decision, including accessibility, fees, customer service, and the range of banking services offered.

- Accessibility is a crucial factor to consider when choosing a bank. You should choose a bank that has branches and ATMs located in your area of residence. Additionally, the bank should have a user-friendly online banking platform that you can access from anywhere in the world.

- Fees are another important factor to consider when selecting a bank in Portugal. Different banks have different fee structures, and some may charge higher fees than others. It is crucial to choose a bank that offers transparent and reasonable fees for services such as account maintenance, withdrawals, and transfers.

- Customer service is also an essential factor to consider when choosing a bank in Portugal. You want to work with a bank that has a helpful and informed customer service team that can answer your questions and help you solve any problems you may have.

- The range of banking services offered is also an important consideration. You should choose a bank that offers a wide range of services, including online banking, international transfers, savings accounts, and investment options.

What type of bank account in Portugal is ideal?

When choosing a bank account in Portugal as an expat, it is important to consider your financial goals and needs. There are different types of bank accounts available, each with its own features and benefits. Here are some details on the different types of bank accounts in Portugal:

- Minimum Service Account: This is a basic bank account that allows you to perform essential banking operations, such as depositing and withdrawing money, paying bills, and making transfers. It typically has lower fees and no minimum balance requirement.

- Current Account: This is a checking account that allows you to access your funds on demand, write checks, and make debit card transactions. It is suitable for day-to-day expenses and managing your cash flow.

- Savings Account: This is an account that allows you to earn interest on your savings while keeping your funds accessible. It is a good option for building an emergency fund, saving for a specific goal, or earning some extra income on your idle cash.

- Investment Account: This is an account that lets you put your money in things like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It’s good for long-term financial goals, but you have to be willing to take on more risk and know more about investing.

What are the benefits of having an account in a Portuguese bank?

Opening a bank account in Portugal can offer a variety of benefits to expats. Here are some of the advantages of having an account in a Portuguese bank:

Convenience: Conducting Transactions in Portugal with Ease

Having a Portuguese bank account makes it much easier to conduct transactions in Portugal. Many Portuguese businesses prefer to deal with local banks, and having a Portuguese account can make it easier to transfer funds, pay bills, and handle other financial transactions. In addition, having a Portuguese bank account can make it easier to receive and send money from overseas.

Widely Accepted: National Card Acceptance at Online Stores

Many online stores in Portugal only accept payments made with Portuguese cards. By having a Portuguese bank account, you can obtain a national card, which will allow you to make online purchases from these stores.

Legal Advantages: Benefits of Transferring Funds to Portugal

If you plan to transfer funds to Portugal, having a Portuguese bank account can offer legal advantages. You can take advantage of tax benefits and avoid costly fees associated with international money transfers. Additionally, having a Portuguese account can make it easier to manage your finances and investments in the country.

Is opening a bank account in Portugal difficult?

Opening a bank account in Portugal is not a difficult process, but it can be time-consuming and requires some preparation. Expats who are planning to live and work in Portugal for an extended period will need to open a bank account to manage their finances, including receiving their salaries, paying bills, and making purchases.

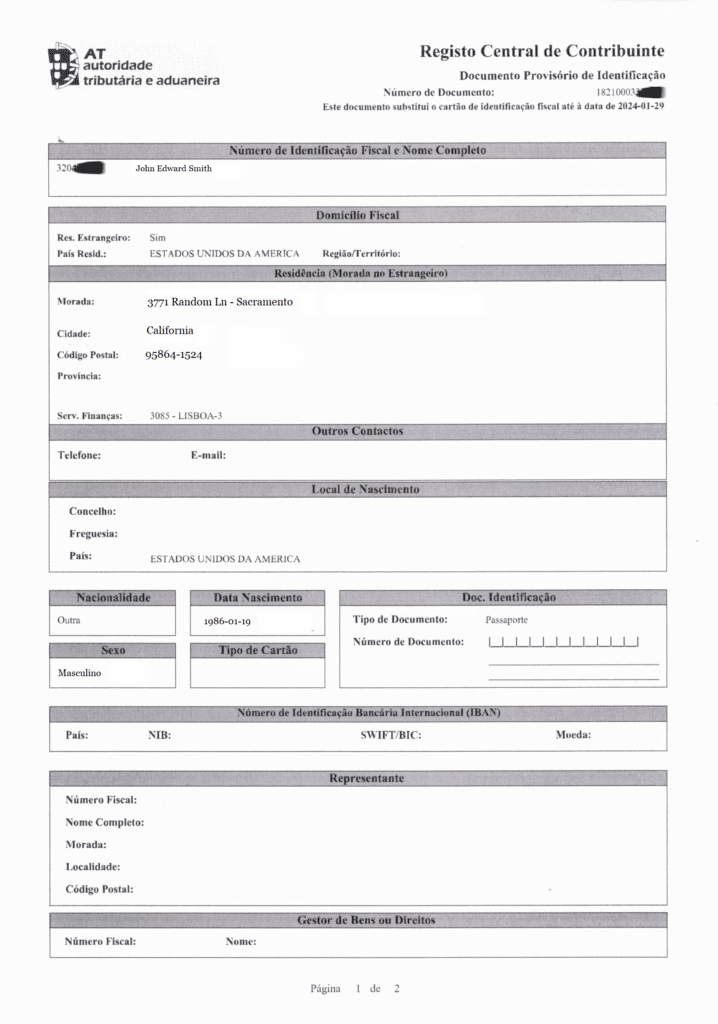

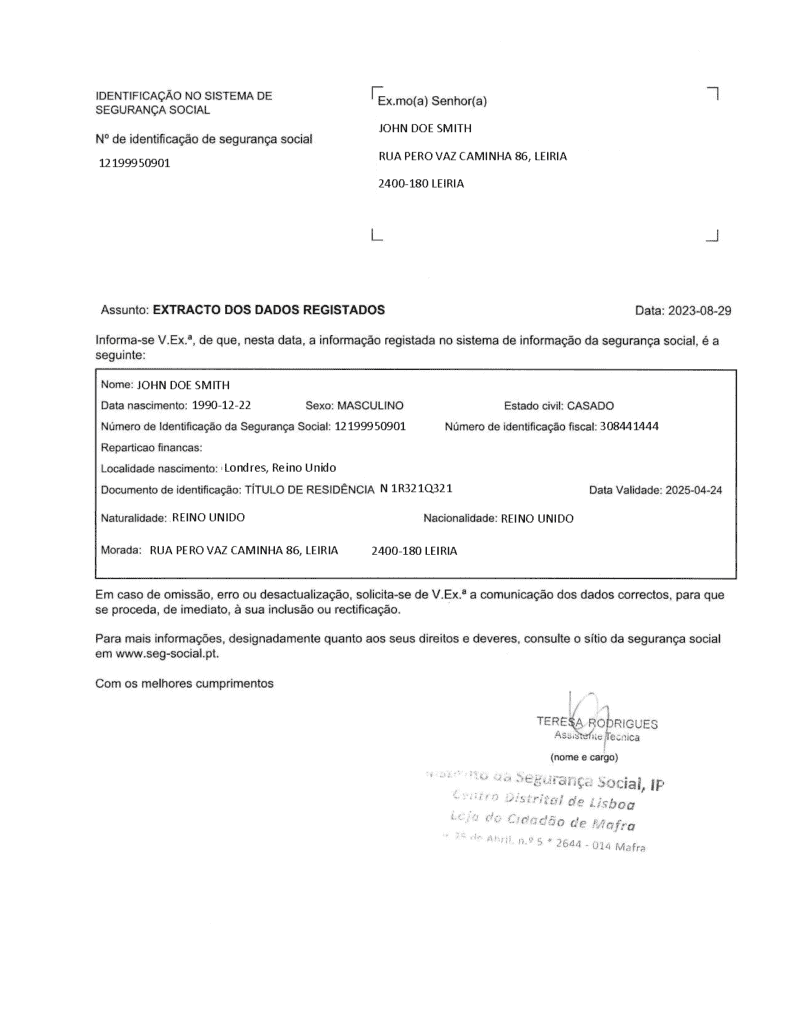

To open a bank account in Portugal, you will need to provide certain documents, including a valid passport or ID card, proof of address, and a tax identification number (NIF). Additionally, some banks may require proof of income or employment, and non-EU citizens may need to show a residency permit.

What are the requirements for opening a bank account as an expat in Portugal?

When it comes to opening a bank account as an expat in Portugal, there are several requirements that need to be met. Here are the most common requirements:

- Valid Identification and Address Verification Documents: To open a bank account in Portugal, you will need to provide valid identification and address verification documents. A valid passport or national identity card is typically acceptable for identification purposes. For address verification, you may be required to provide a recent utility bill or rental agreement.

- Tax Identification Number (NIF): A Portuguese tax identification number, also known as NIF (Número de Identificação Fiscal), is required to open a bank account in Portugal. This number is used to track your tax obligations and financial transactions in the country. You can obtain an NIF by applying at the Portuguese tax office or through a certified accountant.

- Proof of Income or Source of Funds: Banks in Portugal may require proof of income or source of funds, such as a recent payslip or bank statement. This is to ensure that the account holder has a legitimate source of income and to prevent money laundering.

- Residency Permit or Visa: As an expat, you will need to provide proof of your residency permit or visa to open a bank account in Portugal. This is to verify your legal status in the country.

- Portuguese Phone Number and Email Address: Banks in Portugal may require a Portuguese phone number and email address for communication and verification purposes. This is to ensure that the account holder can be reached easily and to prevent fraud.

How can a foreigner open a bank account in Portugal?

Foreigners can open a bank account in Portugal by following the necessary procedures and providing the required documentation. Here are the general steps:

- Choose a Bank: The first step is to choose a bank that meets your needs as an expat in Portugal. Do some research to compare the different banks, their fees, and the services they offer.

- Gather Required Documentation: The next step is to gather the necessary documentation. This typically includes a valid identification document such as a passport, proof of address, and a tax identification number (NIF). Some banks may also require proof of income or source of funds.

- Visit the Bank: Once you have gathered the necessary documentation, visit the bank of your choice in person to open the account. Be prepared to speak Portuguese or have a translator with you.

- Fill out Application Form: The bank will provide you with an application form to fill out. Be sure to provide accurate information and ask any questions you may have.

- Wait for Approval: After submitting your application and all required documents, the bank will review your information and approve or deny your application.

- Receive Your Bank Card: If your application is approved, you will receive your bank card and PIN within a few days. You can then begin using your account to manage your finances in Portugal.

Conclusion

There are many options for expats looking to open a bank account in Portugal. You should consider factors such as accessibility, account opening process, customer service, account fees, banking services, technology, and trustworthiness when choosing the right bank.

Expats can choose between traditional brick-and-mortar banks or online banks that offer mobile banking services. Expats can benefit greatly from having a Portuguese bank account, including convenience, acceptance of national cards at online stores, and legal advantages for transferring funds to Portugal.