Moey! – The Best Digital Bank in Portugal? A Comprehensive Review

In 2019, moey! was launched in Portugal as a Portuguese alternative to the digital banks that have revolutionized the market in recent years, such as Revolut, N26, and Monese.

Moey! is a digital bank that emerges from the Crédito Agrícola Group, with whom it shares a banking license.

I started using moey! in 2020 due to the high fees of my traditional bank, and it remains one of the best choices I’ve made.

With a user-friendly app, moey! provides access to a virtual and a physical debit card without any cost.

The app allows you to have full control of your expenses in a simple and uncomplicated way.

In this review, I will share my experience as a moey! customer in 2023 and discuss the benefits that have kept me loyal to this bank for 3 years.

What Are the Benefits of Moey?

Moey! appeared at a time when Revolut was becoming increasingly important in Portugal and was revolutionizing the banking sector.

When I heard about moey!, I immediately created an account to enjoy all the advantages of this new 100% Portuguese digital bank, which is integrated into the Portuguese ATM network called Multibanco, unlike Revolut.

Moey! is backed by Crédito Agrícola

Moey! is a financial institution that belongs to the Crédito Agrícola group and operates under the same license. This means that you can use moey! with the security of a major bank but without paying as many fees.

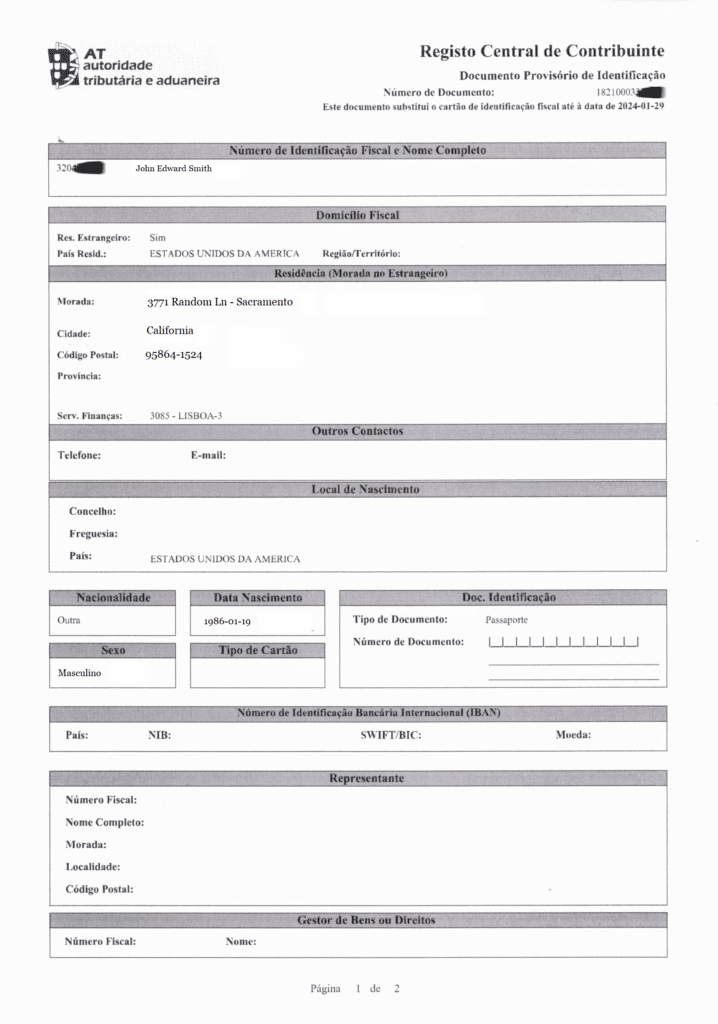

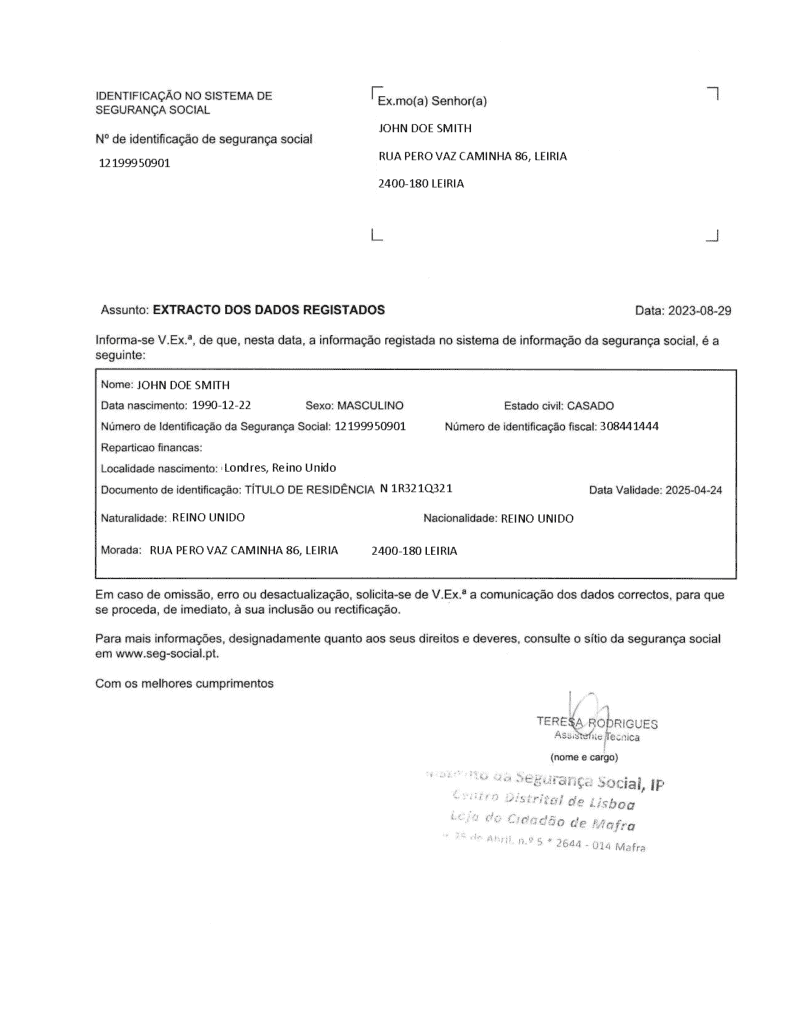

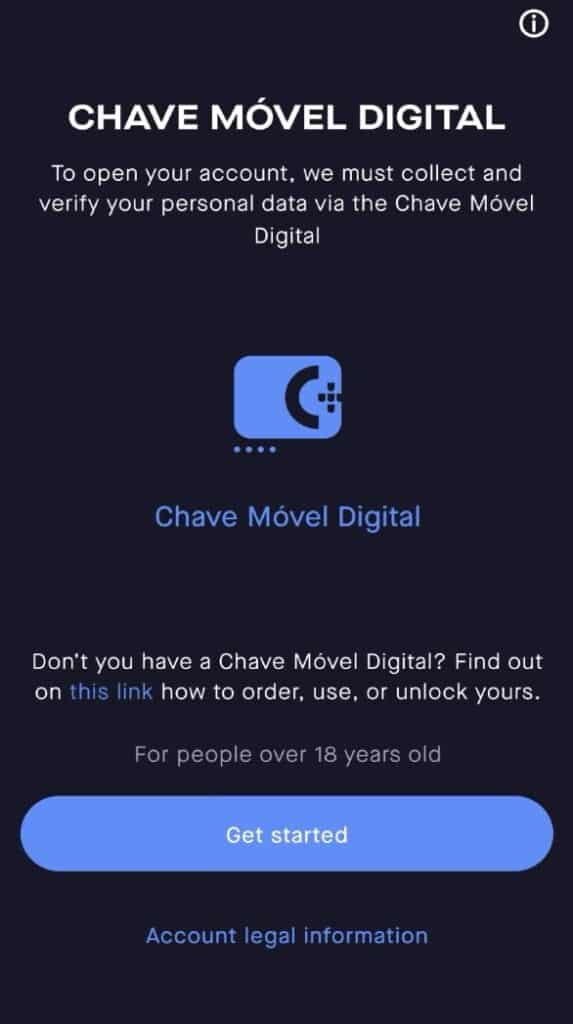

You can open an account quickly

Opening an account at moey! is very simple and takes less than 5 minutes. There are two ways to do it: make a video call with an assistant or use the Portuguese Mobile Digital Key that allows you to open an account without speaking to anyone.

In my case, I only needed to confirm a code that I received on my phone number through the Digital Mobile Key, take a picture, and immediately had access to the account.

You will need an Identification document (Citizen Card, Residence Card, or Residence Permit), be over 18 years old, and have an address in Portugal.

You can choose the language

The application is available in Portuguese and English.

You can start using your card immediately

I received my card at home a week after I created my account, but I started using the virtual card right away as it was immediately available and without any spending limits.

No maintenance fee

Opening an account is free, and there is no maintenance or annual fee for the debit card.

Free IBAN bank transfers

Bank transfers are free of charge, both in the SEPA area and via MB WAY.

Moey! also gives you 40 immediate transfers free of charge every month in the SEPA area. After the 41st transfer, the operation has a cost of 50 cents.

The only fee you pay is if you withdraw money outside the Eurozone, in which it is charged 1.7% of the amount withdrawn, an amount that is very competitive when compared to a traditional bank.

There are no withdrawal fees

In the Eurozone, you can make withdrawals without any fees.

What are the limits for withdrawal?

You can withdraw 400€ per day. The maximum limit per withdrawal is 200€.

It’s 100% online

Moey! has no physical branches, so all services are online.

It’s easy to make online payments

I’ve never had a problem making payments online; with 3D Secure, you simply go to the app and approve the payment.

The exchange rates are good

Moey! applies the exchange rate set by the Crédito Agrícola Market Room on the day the transfer arrives in your account.

It is important to mention that these exchange rates are updated only once a day during business days, which may result in unfavorable exchange rates in specific cases.

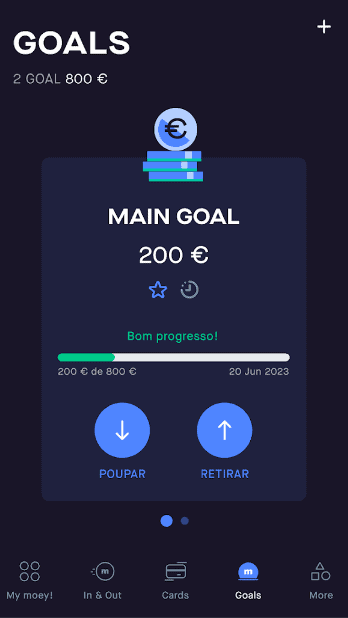

There is a savings account

Moey! has an associated savings account, divided into so-called Goals, or pre-defined objectives for which you can start saving.

They allow you to create goals by setting the amount to be reached and the date.

You can interactively follow the entire process and understand how you can reach the required amount.

To help you out, moey! allows you to round up your bills and send them to one of the goals of your choice or to your savings account.

You can control your expenses

One of the things I like the most about moey! is being able to keep track of my monthly expenses in a simple way.

The app provides a summary of expenses broken down by category and sub-category, and most of the time, the right category is assigned correctly.

The app also allows you to add other bank accounts to see all the transactions you make and organize them by categories.

You can create groups to share expenses

You can create a group to include your friends and keep track of who has paid and remind those who forgot.

You can personalize your transactions

You can add images to your transactions, share with your groups, and insert notes.

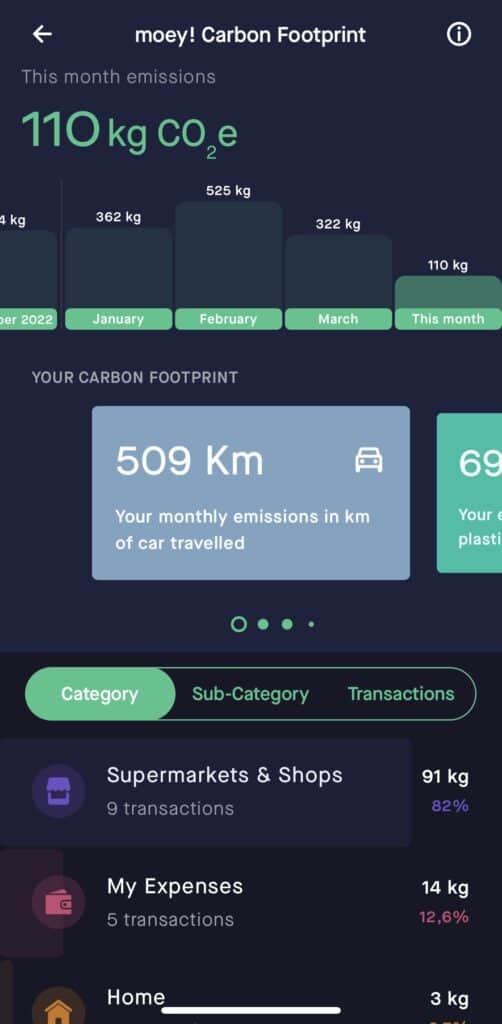

You can see your Carbon Footprint

One feature of the app that I find very interesting is that it calculates an estimate of your Carbon Footprint.

Through your transactions, you get to know the amount of CO2e produced by your expenses, either by monthly total or by category.

Moey! and Google Pay: Digital Payments Integration

Moey! is fully compatible with Google Pay, allowing you to make payments using your phone.

The process of setting up Moey! with Google Pay was easy and it took me just a minute. I added my Moey! debit card to my Google Pay app and it was ready to use.

What Do I Dislike About moey?

Although moey! has many positive aspects, it also has some things that can be improved.

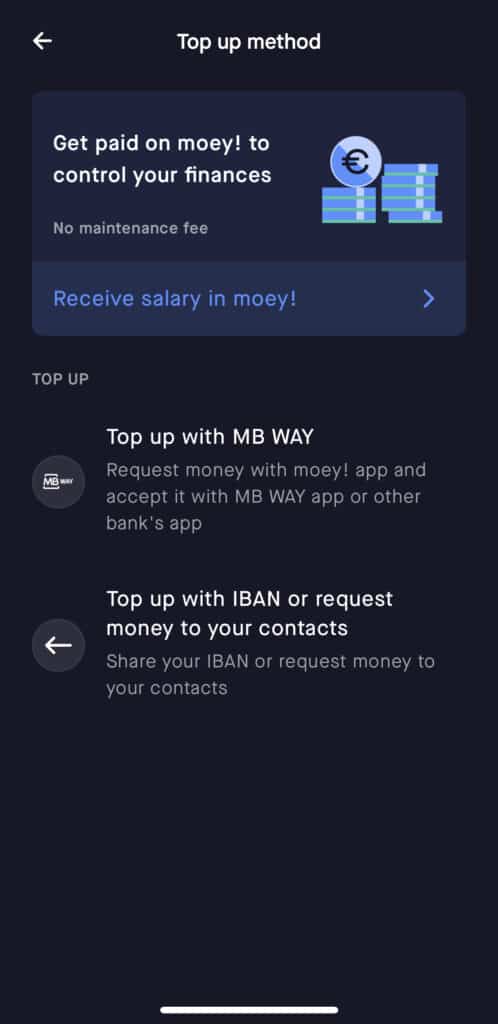

The top-up options are limited

The moey! account does not allow cash deposits, so to top up your account you have two options:

1. Request money from your friends using moey! or MB WAY;

2. Transfer money to your IBAN.

Therefore, it is not possible to use a debit or credit card to top up the account, as allowed by other digital banks.

There are no physical branches

Moey! has no in-person branches, and all customer support is provided by e-mail, WhatsApp, or phone.

So far, I have received excellent feedback from customer support, but it makes me a bit apprehensive to use a bank account without a physical presence where I can go if needed.

Too much advertising for personal loans

One of the things I haven’t liked recently is receiving some notifications suggesting taking out a personal loan.

For example, when a goal I have created is below the amount needed to be completed by the target date, moey! sends me a notification proposing a personal loan.

I think this somewhat ruins the user experience, and I don’t like to receive these kinds of notifications.

Limited services

If you are looking for a bank with a wider range of services, moey! is not for you.

The savings account has no profitability, and if you want to invest your money, you have to go to a traditional bank.

Only SEPA transfers allowed

Moey! only supports SEPA transfers, so you can only transfer money to the 36 countries in SEPA.

There is only the night mode

With the latest update, moey! no longer has a light mode, meaning that the application is always in dark mode.

If at first, it was a little uncomfortable as I always prefer the light mode, the truth is that eventually, I got used to it.

Still, I think they should let the user choose between light and dark modes based on their preference.

Is moey! safe?

The moey! card has only the cardholder’s name marked, and all other information is shown only in the application which I think is an excellent idea.

Moey! features the NuDect service that ensures that you are the one making the purchase online. NuDect evaluates and verifies your behavioral data, including how you interact with your cell phone or computer at the time of purchase.

Moey! belongs to the Crédito Agrícola Group and all its accounts are covered by the Guarantee Fund, which guarantees up to €100,000 per depositor.

This means that your account balance is protected, even in the event of insolvency, up to a maximum of €100,000.

Moey! vs ActivoBank vs Revolut: A Comprehensive Comparison

One of the reasons that made me choose moey! over Revolut is the fact that moey! is integrated into the Portuguese ATM system and has MB WAY, which is not the case with other digital banks such as Revolut or N26.

With this integration, moey! cards are accepted everywhere in Portugal, allowing you to make payments with Apple Pay and Android Wallet NFC.

Moey!, ActivoBank, and Revolut are the three main digital banks used in Portugal. In this section, we will compare them in terms of their features, fees, and overall user experience.

Pros and Cons of using Moey! in Portugal

Moey! offers a quick and easy account opening process, and it’s completely free.

Pros

Cons

Pros and Cons of using ActivoBank in Portugal

ActivoBank was one of the pioneers of Portuguese digital banking solutions and provides all the services of a traditional bank.

Pros

Cons

Pros and Cons of using Revolut in Portugal

Revolut was the first major digital bank to succeed in Portugal and remains one of the most popular.

Pros

Cons

Moey! vs ActivoBank in Portugal

- ActivoBank has physical branches, unlike Moey!;

- Moey! allows you to make 40 immediate transfers per month, while in the case of ActivoBank, it costs 1.66€ per transfer;

- ActivoBank has three different account plans, while Moey! has a single free plan;

- Both ActivoBank and Moey! support SEPA transfers.

Moey! vs Revolut in Portugal

- Revolut is not accepted at all payment terminals, unlike Moey! which is integrated into the Portuguese ATM network;

- Moey! does not allow you to transfer out of the SEPA area, unlike Revolut;

- All payments in foreign currency are free with Moey!, while at Revolut, you pay a weekend fee of 1%;

- Moey! does not allow you to convert foreign currency balances, while Revolut has 29 currencies available.

Conclusion on Moey! vs ActivoBank vs Revolut

As you can see, each of these digital banks offers unique advantages and drawbacks.

Moey! and ActivoBank provide a more localized experience with integration in the Portuguese market, while Revolut offers global support and a wider range of features.

My summary about Moey!

Overall, I am delighted with my experience using moey! as my primary bank account in Portugal. The integration with the Portuguese ATM network and MB WAY, along with the user-friendly app and excellent customer support, have made my life easier.

However, moey! is not perfect, and there are some aspects that could be improved, such as top-up options and the limited range of services offered. Nonetheless, I believe moey! is an excellent alternative for those looking to switch from traditional banks to a digital banking experience with fewer fees and more control over their finances.

If you live in Portugal and are considering making a change, I highly recommend giving moey! a try. Remember, opening an account is free and easy, so there’s no harm in testing it out for yourself to see if it meets your banking needs.